How Smart Brokers Beat the Market ?

The CRM dividend to wiser expansion, stronger trust, and better margins.

A successful broker is no longer merely selling policies. It’s using Salesforce to automate, predict clients’ needs, and monetize information into repeatable profit. Today in the Salesforce Insurance Industry, being a mediocre and best-of-industry broker is merely a function of how skilled they are at making money out of automation and data.

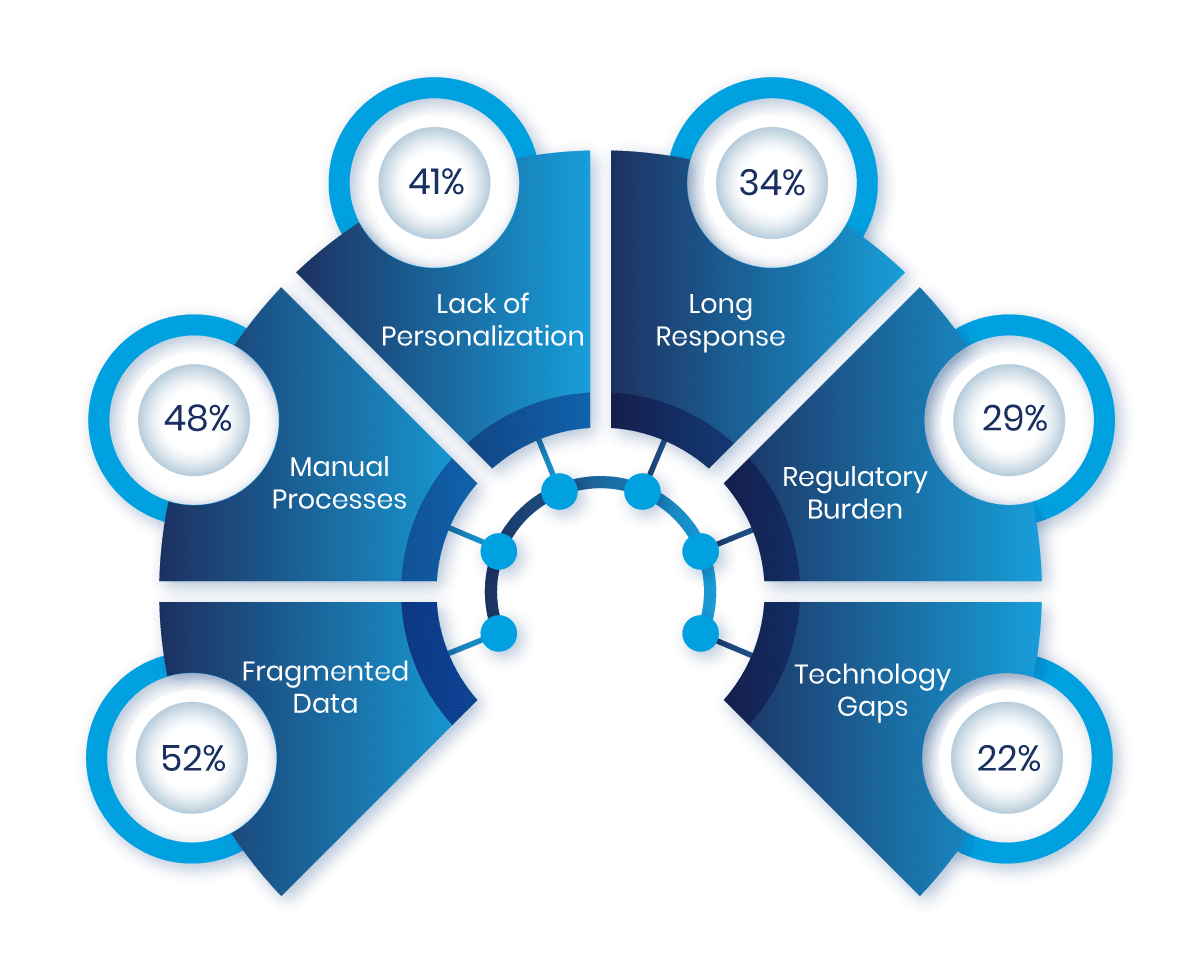

The Profitability Challenges Facing Today's Brokers

Insurance brokers today are confronted with decreasing margins and increasing client expectations. While eCommerce businesses lose revenues with cart abandonment, clients also lose out when client experiences go awry. The following are the greatest challenges brokers need to overcome in order to achieve profitability:

Why This Matters

As nearly 7 in 10 web customers abandon their cart, so does a huge chunk of insurance buying customers abandon when brokers fail to deliver on speed, personalization, and trust promises.

The Salesforce Solution

The Salesforce insurance industry is not a CRM. It’s the power engine that turns these challenges into opportunities by:

• Uniting client data into a source of truth.

• Reassigning duplicate labor to free broker time.

• Enabling personalization with AI-driven insights.

• Compliance by open tools built in the center.

Built for Today’s Brokers, Built for Profitability

Smarter Policy Management with Real-Time Insights

Use AI tools to score risks, predict renewals, and group customers. This helps brokers find the best opportunities faster. Further, helps deliver more personalized Salesforce for insurance solutions.

Seamless Automation Across Insurance Tasks

Salesforce makes work faster by automating quotes, policy issuance, and claim processing. This saves brokers time and lets them focus more on clients.

360° Client View for Stronger Relationships

Bring all client data like policies, claims, and communications into one easy dashboard. With a complete view, brokers can give better advice and earn long-term trust.

Flexible, Scalable & Compliance-Ready

Salesforce Insurance Industry solutions extend to agencies of all sizes with elastic workflows, out-of-the-box connections, and regulatory compliance features that respond in real-time to changing law.

Why Brokers Trust Salesforce Insurance

Platform-designed for scale, built to enable brokers to sell smarter and have deeper relationships with clients.

Salesforce Insurance Cloud vs Traditional Insurance CRMs

Compare Salesforce for Insurance to legacy insurance CRMs on automation, compliance, customer engagement, claims handling, and more.

• Salesforce Insurance Cloud – Offers AI-based lead scoring, policy management automation, 360-degree customer insights, and compliant regulatory flows to help insurers and brokers close business quicker and deliver better customer experiences.

• Legacy Insurance CRMs – It only stores basic client data. They handle policy changes manually. Plus, they usually lack advanced automation. Further, they also miss out on real-time analytics. Most of them do not connect well with modern communication platforms.

• Generic CRM platforms – It offers standard CRM features. They mainly focus on contact management. Also, they do not support insurance-specific needs. Further, they lack tools for underwriting, claims tracking, renewals, and compliance.