How Salesforce CRM for the Insurance Industry Turns Policyholder Data into Predictive Insights

Insurers work with vast amounts of data on a daily basis, and Salesforce CRM in insurance industry far too frequently is the gatekeeper to making it understandable. Policy applications, claims history, customer service incident reports, and underwriting information accumulate rapidly, yet little of it ever makes it to decisions.

It all resides in silos like claims in one system, underwriting in another, and customer service notes somewhere out of sight. It all encourages insurers to be looking back at what is behind them and not forward at what may be in front of them.

Salesforce CRM flips that ratio on its head. It reshapes disorganized data into clear, predictive patterns. Rather than simply tracking policies, the system enables insurers to observe trends that predict outcomes ahead of time. What once could be viewed as random entries in a database is now a signal of churn risk, renewal probability, or nascent claims patterns.

The true value is in anticipation. Imagine being able to know who is most likely to non-renew a policy, who is most open to an upsell, or which risk of claim has the greatest chance of getting out of hand before it happens.

With predictive analytics powered by Salesforce CRM, insurers transition from reacting to issues to anticipating them, creating a stronger, more anticipatory insurance experience.

Insurance Is No Longer in the Past, But Forecasting

Insurers relied on scores of reports, and Salesforce CRM in insurance industry traditionally offered a mechanism of retaining policyholder data, claims history, and premium payments as a historical record.

Insurers made decisions for decades based on what happened in the past whether the number of previous claims, how often they paid late, or the chance to renew based on prior experience. That rearview style insulated them but barely forecasted the changes occurring in real time.

Reactive players no longer earn consistent returns in the current market. Insurers are being requested increasingly by consumers to anticipate their requirements before they can even give them a voice, and risks emerge earlier than they can be quantified with the assistance of past data.

Forecasting nowadays is where competitiveness begins. Insurers can glimpse results in the future that appear much sooner before they are apparent by viewing pointers along the way such as digital behavior, service requests, changes in lifestyle, or local trends.

Salesforce CRM drives the move from looking back at history to seeing ahead with clarity. Rather than merely capturing what has happened, it uses intelligence to predict who will churn, which policies will renew, and where risks will become most acute. This shift is far greater than a system update. It is a shift that redefines the very fabric of insurance, from one of reactionary protection to proactive guidance.

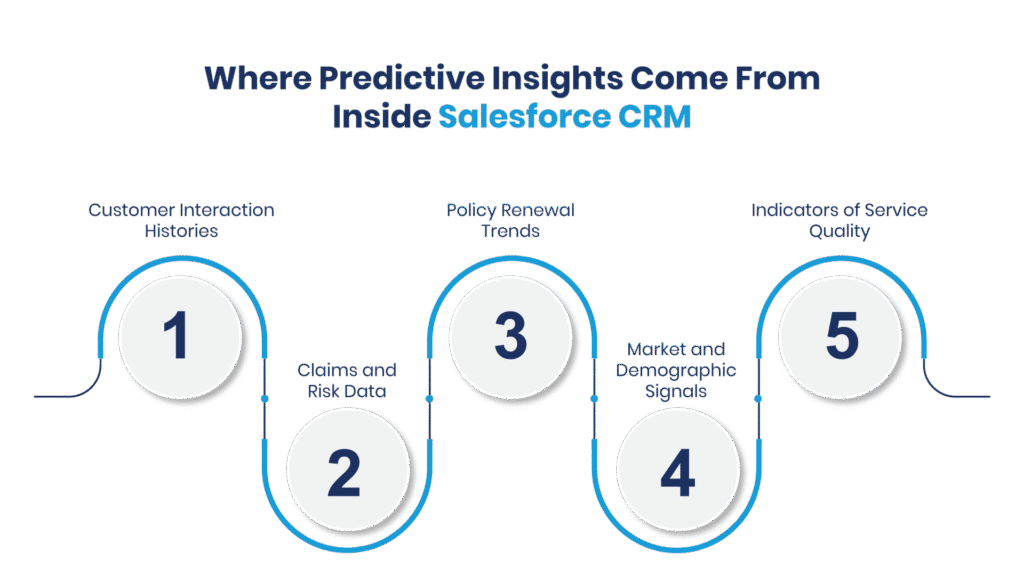

Where Predictive Insights Come From Inside Salesforce CRM

Insurers deal with huge amounts of customer information, and insurance CRM Salesforce translates raw material into signs of the way things are going to turn out someday. Salesforce CRM in insurance industry doesn’t just import policies and claims. It reads between the lines and tells insurers what is going to happen. That sort of forward-thinking analysis is a result of some serious mojo in the platform.

Customer Interaction Histories

Each call, email, or service request is a data point. Salesforce CRM documents these interactions and alerts on behavioral changes, such as a customer abruptly turning off interaction. This subtle hint can lead to potential churn risk, enabling insurers to act before a policy is at risk.

Claims and Risk Data

Claim trends indicate where the risk also concentrates. By looking at comparable policyholders’ claim history, Salesforce CRM determines red flags beforehand. Insurers may avoid fraud and frequent claims rather than responding to them.

Policy Renewal Trends

Salesforce CRM also monitors premium payments, renewal cycles, and responsiveness of customers. It foretells which policies are likely to be non-renewed and with whom additional coverage is likely to be sold. Insurers place their efforts on policyholders who matter most.

Market and Demographic Signals

If insurers wed CRM data with external demographic or geographic data, they reveal trends that inform product development. For instance, market demand for a specific kind of coverage in a specified geographic area is apparent before competitors realize that a trend is at play.

Indicators of Service Quality

Customer satisfaction metrics such as resolution time and complaint ratios are input into predictive models in Salesforce CRM. Service delay is generally associated with churn, while fast resolution propels loyalty. Insurers use these results to improve service quality before its impact on retention.

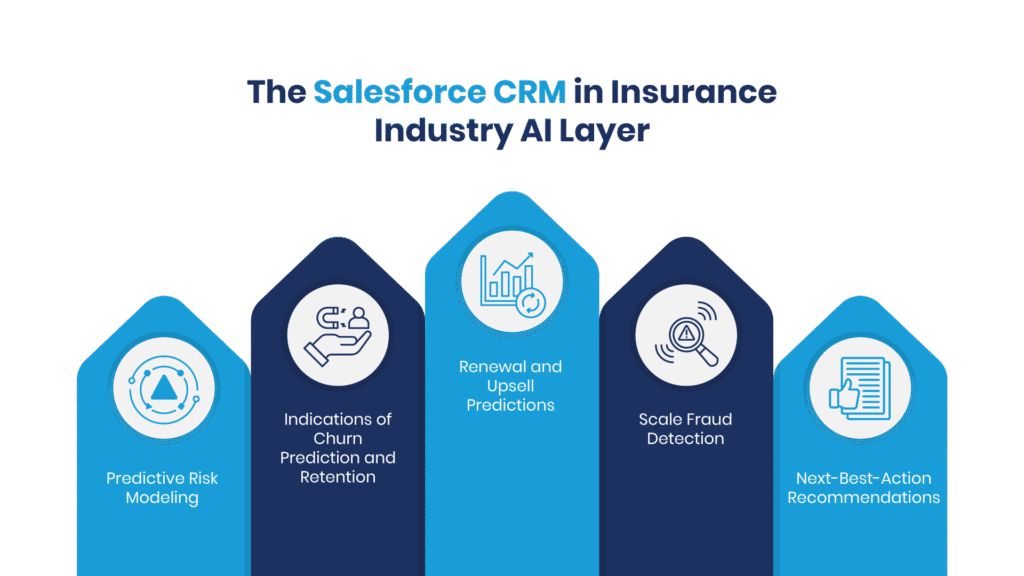

The Salesforce CRM in Insurance Industry AI Layer

Insurers collect boundless streams of data, and Salesforce CRM in insurance industry is that much more forceful when Salesforce AI translates that data into vision. Rather than keeping data as static records, the layer of AI reads in wisdom dynamically, forecasts behavior, and guides insurers toward decisions that are data-driven. Through this, insurance teams are empowered to be able to shift from responding to yesterday’s challenges to envisioning tomorrow’s opportunities.

Predictive Risk Modeling

Salesforce AI looks for claim histories, payment trends, and lifestyle markers to find potential future risks. Identifying anomalies early on by insurers allows them not to trigger claims but rather to process them later.

Indications of Churn Prediction and Retention

AI customer interaction frequency, service contact, and policy activity analysis illuminate whom to anticipate bolting. Accurate warnings inform insurers to act in advance to perform actions that will foster loyalty.

Renewal and Upsell Predictions

The AI maturity lays the groundwork for which policyholders are most likely to renew and which are weighing additional coverage. This expectation enables insurers to be able to have the right conversation at the right time, which generates efficiency and profit.

Scale Fraud Detection

Seriously anomalous patterns of claims or strange behavior come into view when Salesforce AI cross-matches them with thousands of comparable records. Insurers shift from the postmortem detection of fraud to preventing it the instant warning signs emerge.

Next-Best-Action Recommendations

AI doesn’t just forecast, it also suggests. Salesforce AI shows the next best action for every policyholder, based on customer context, such as a customized product recommendation, right-time service call, or accelerated payout of a claim.

Challenges No One Discusses

New technology enters organizations with high hopes, and Salesforce CRM in insurance industry has a habit of assuring efficiency, intelligence, and improved customer relationships. Beneath the smooth dashboards and automation, however, insurers are encountering problems that never appear in vendor marketing materials. They do not depreciate the value of CRM, but they multiply if insurers must deliver tangible results.

Data Overload Without Context

Insurers collect tremendous amounts of customer and claims data. Without strategy, that data swamps systems rather than generating insight. It’s not a matter of information, it’s using it in real time.

Gaps in Integration Across Departments

Different platforms often support underwriting, claims, and customer service, creating silos. When they don’t cross-function with the CRM, great insights sit in silos. That gap halts decision-making and slows response.

International Resistance to Change

Workers accustomed to working in old processes view CRM as additional work and not a smart tool. Absence of training and cultural adoption drops adoption rate, and the system is used as a contact manager.

Achieving the Right Amount of Automation

Automation is increased, but insurance remains a matter of faith and intelligence. Excessive automation could spook those wanting to be treated specially, particularly at claim time. It should be a priority to get the right balance.

Security and Compliance Burden

Insurance information contains sensitive personal and financial data. A security-and-compliance-not-configured CRM has risks exceeding the benefits. Trust is ensured through ongoing monitoring and updating.

The Future Orientation is Anticipatory, Not Reactive

There are unforeseen changes in customers’ requirements, and Salesforce CRM in insurance industry today is a strategic roadmap that propels them to anticipation, not reaction. Rather than letting claims accumulate or renewals drop off, insurers can leverage CRM insight to look forward and scan patterns and become proactive partners. This vision ahead transforms insurance from a reactive service to a predictive experience.

Anticipatory Customer Contact

CRM insight enables the insurer to make contact with policyholders before they contact them. Tipping them for lifestyle risk or making timely policies, insurers gain trust by initiating action before needs.

Predictable Policy Renewals

Through monitoring of behavior and web signals, insurance CRM Salesforce systems predict the most likely policies to be renewed and the most likely to lapse. By preempting, insurers can react before and safeguard income.

Risk Warning Prior to Them Getting Out of Hand

Insurers do not have to wait until a claim is made to discover where things would go wrong. CRM applications review environmental, behavior-based, and geographic data to identify threats in advance so that teams may evade loss before it happens.

Tailor-Made Product Development

Future-looking insurers design products after anticipating what customers will need, and not on what they bought before. CRM forecasts inform new insurance planning to respond to new life occasions and marketplace trends.

Opposite to the Insurer’s Role

The new insurer is not so much a troubleshooter as a risk advisor. CRM-predicted advice rephrases the relationship by demonstrating to customers that their insurer acts to safeguard them in advance of trouble before it ever occurs.

Conclusion: The Predictive Advantage

Insurers must be able to navigate a sea of constant change, and Salesforce CRM in insurance industry redefines their role from documenting history to anticipating outcome. The moment firms treat CRM as more than a database, they unlock early warnings, renewal patterns, and risk insights that competitors cannot access. This vision capability does more than defend margins. It creates loyalty, builds trust, and alters what policyholders can expect from their insurers. Those firms that view the future rather than respond will be establishing the tone for the whole industry.

Begin imagining your CRM as a foresight engine, not a storage repository. Discover how predictive insights can transform your underwriting, claims, and customer engagement approaches. Innovative thinkers will define the way Salesforce CRM for insurance reshapes the sector.

For more insights, updates, and expert tips, follow us on LinkedIn.