How Can Salesforce Transform the Insurance Customer Journey?

Salesforce for insurance is key to addressing today’s customer demands. Policyholders won’t wait for days for details or updates. Policyholders want immediate answers, simplified access to information, and clear communication as they move through the process. Insurers using old processes are losing trust and missing opportunities. Speed and personalization define the journey now.

Salesforce for insurance provides a mechanism to connect teams and data and workflows to provide seamless experiences. Agents have real-time visibility for tracking leads, policy details, and claims. Utilizing guided workflows, service teams can quickly address customer needs, while related personalized updates ultimately build trust and loyalty from customers.

By connecting both internal and external communications, Salesforce helps insurers differentiate themselves and remain competitive while exceeding customer expectations.

The Customer Journey in Insurance Today

The customer journey is changing fast, and Salesforce for insurance keeps pace with it. Buyers are looking for quick quotes, easy onboarding, and instant support. They can compare policies with ease, and clarity is required at every stage. When claims are involved, it is all about scoring, accuracy, and continuous updates. Every point of contact matters, and every point of contact contributes to trust.

Salesforce insurance solutions provide insurance professionals with the ability to help customers with accuracy and as efficiently as possible. Agents respond to customer inquiries quickly to close deals with little friction.

Service teams will mitigate issues before they can ever even arise. A personalized touch will make customers feel valued and that they are appreciated.

The client journey becomes a smoother, deeper, more intelligent experience, focused on retention and securing long-term loyalty.

Where Salesforce for Insurance Delivers Value

Salesforce insurance solutions provide a transformative and powerful shift in the way insurers conduct their business. The platform enables teams to effectively respond to the needs of their customers with speed and precision and connects each group of the insurer to offer a customer journey that feels easy, breezy, and personal. Insurers have the competency to act faster, make better decisions in the best interest of their customers, and better meet expectations.

1. Faster Sales Cycle

The Salesforce insurance solutions help agents work from up-to-date data and use lead processes and present a sense of predictability on the agents ability to close business quickly, while still educating customers accurately on their decisions.

2. Faster Claims Processing

Automated workflows reduce or eliminate workflow steps and remove delays on transactions. Service teams will approve claims and update customers with the speed and accuracy.

3. Personalized Communication

Agents leverage insights to create meaningful conversations and deliver personalized communication to policyholders. Customers feel valued and noticed, and they build trust and loyalty.

4. Greater Operational Transparency

Real-time dashboards provide leaders an instant overview of the sales/pipeline, claims, and renewals. Teams will measure data, not assumptions.

5. Enhanced Customer Loyalty

Every touchpoint should be seamless and consistent, resulting in customers that stay engaged and satisfied and are ready to renew.

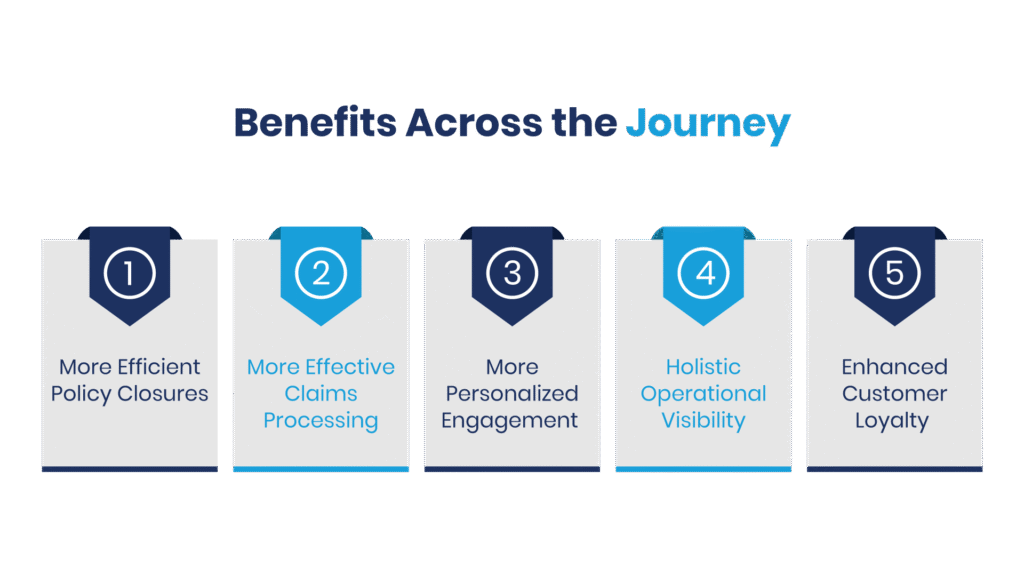

Benefits Across the Journey

Insurers derive quantifiable benefits when the customer journey is powered by Salesforce insurance solutions. Delivering good customer experiences requires teams to act rapidly, communicate with clarity, and provide consistent experiences. Customers benefit from seamless onboarding, timely updates to their policy, and highly personalized experiences. While each stage of the process creates an opportunity for trust and loyalty to form.

1. More Efficient Policy Closures

Agents utilize real-time data in the insurance block to drive buyers through the underwriting process. Resulting in less unnecessary delays and faster policy closures.

2. More Effective Claims Processing

By simply implementing Salesforce insurance solutions claims processing, insurers benefit greatly from the efficiencies of the platform, which ultimately ensures that claims workflows are streamlined, case resolutions are attained quickly, and accuracy is delivered overall.

3. More Personalized Engagement

Agents and others can continually gather insights from customers to create personalized messaging for everyone leading up to and following policy purchase. Policyholders are then left feeling understood and valued.

4. Holistic Operational Visibility

Dashboards and reporting deliver instant clarity to company leaders on the state of the business, and teams then have an instant process to act on accurate data that will allow teams to make significantly better decisions.

5. Enhanced Customer Loyalty

A consistent experience at every touchpoint builds confidence and trust in consumers, keeps them satisfied, and motivates them to renew.

How the Insurance Customer Journey Is Becoming Seamless with Salesforce

Insurance processes have become more efficient when connected to Salesforce for insurance. Policyholders receive immediate quotes, status updates, and claims processing cannot be faster.

Agents can view all relevant information within one place. Omnichannel, also known as “anytime, anywhere,” customer communication is anticipated at the various touchpoints. The end customer journey provides a simple, quick, and personalized experience.

Salesforce insurance solutions eliminate obstacles across sales, service, and operations. Automated workflows can lead to quicker approvals and renewals. Personalized insights help agents recommend policies suited to their customers’ profiles. Dashboards enable leadership to monitor and provide real-time insights for their decision-making processes. This seamless customer journey helps to create trust and loyalty at every stage of the process.

Impact on the Policy Cycle of Salesforce for Insurance

When the policy cycle is managed with Salesforce insurance solutions, teams do things quickly. Agents have access to track leads, approval, renewals, etc., in real time. Policies increase their speed of movement from application to approval.

Customers can also receive updates in real time at each stage of the process. Teams likewise reduce errors and result in less time to complete each action.

Salesforce insurance solutions speed up renewals and cross-sell initiatives. Automated workflows guide agents through documenting conditions or approvals. Dashboards provide a clear picture of policy status to facilitate quicker decisions.

Gathering all claims and any follow-up adjustments is automatic and will relieve staff from manual bottlenecks. The end result is a smoother, quicker, and more reliable policy cycle that benefits customers and teams alike.

Conclusion

When Salesforce for Insurance powers operations, insurance teams enable speedy and smarter results. Agents close policies faster, service teams resolve claims quicker, and customers enjoy uninterrupted experiences. And every touchpoint booked trust, loyalty, and longevity. Insurers benefit with clarity, speed, and a competitive edge.

Are you ready to reimagine your insurance operations? Make the leap to using Salesforce for insurance. Streamline workflows, enhance customer journeys, and accelerate results. Take the first steps towards smarter policies, quicker claims, and meaningful growth.

FAQs

What is Salesforce for Insurance?

Salesforce for insurance is a customer relationship management (CRM) platform that connects agents, teams, and customers, streamlining the sales, claims, and policy management while improving customer engagement.

How is the customer journey improved by using Salesforce insurance solutions?

Salesforce provides automatic updates in real time & transparent communication, reducing things to fulfill customers through a faster onboarding process. You will enjoy smooth interactions at every touchpoint, building additional trust & loyalty along the way.

How do Salesforce insurance solutions impact the policy cycle?

Salesforce expedites steps involved in the policy cycle such as application, approval, and renewal. Workflows can be automated to remove delays and mistakes and to allow agents to manage policies with speed and efficiency.

What benefits do insurance teams see using Salesforce insurance solutions?

Teams close policies faster, resolve claims faster, and make better decisions based on information and data. Dashboards help to see sales, service, and operations.

How should insurers implement Salesforce insurance solutions?

Review current workflows and identify gaps. Identify a Salesforce provider, build and implement the platform, and use dashboards and automation to facilitate operations.

For more insights, updates, and expert tips, follow us on LinkedIn.