Why Insurance Companies Are Turning to Salesforce

Salesforce for Insurance Industry starts with a well-known narrative. The stereotypical insurer’s office, filled with reams of paper, delayed claims, and teams working in isolation. Agents waste time chasing approvals instead of servicing customers.

Each claim sits on someone’s desk, and each time it moves along the process, it takes longer than before. The customer waits for news that will not come in time. Expectations have shifted; the system has not.

Today, people expect immediate quotes, the ability to track claims digitally, and tailored service through any channel they choose. The gap between what a customer expects and what an insurer provides widens every day.

That is when Salesforce enters the story, not as another CRM, but by revolutionising how insurance companies operate. Salesforce connects every team, automates manual processes and turns disparate data into actionable insights. Agents can finally see what the customer needs before the customer asks.

Business can move faster, and every engagement feels personal and human. Salesforce for the Insurance Industry changes an organisation from something slow, paper-based, and reactive to a business that is fast, connected, and progressive. This approach brings the nimbleness of a startup to an industry that has been operating for generations.

The Legacy Lockdown is What Insurers Lack

Within every traditional insurance company, insurance Industry for Salesforce reveals the root causes of slow growth. Legacy systems hold valued data in silos. The agent is unable to quickly locate the information to serve the customer in a manner that meets their expectations. Each department operates on its own island, apart from the various departments that are part of the company.

Managers use antiquated reports that don’t illuminate what is really happening in an actual timeframe. Competition continues to intensify, and the company relies on inefficient, antiquated systems that take time, energy, and focus from everything else.

Customers move at a rapid pace, while an insurer gets stuck. Manual claim approvals are unfairly slow. Paper-driven workflows stifle efficiency. Even a simple policy change requires multiple approvers. Teams experience frustration as the opportunity to respond swiftly passes by.

The market is no longer going to wait for slow responses and antiquated systems. In order to find the future, insurers must break the digital chains of the old habits and find new agile, connected ways to work.

Salesforce for Insurance Industry is More Than a CRM, a Digital Core

When insurers reach a tipping point for inefficiency and data chaos, Salesforce for Insurance Industry takes action to rebuild the foundation. It’s not just about keeping track of contacts or managing leads. It connects every process, every policy, and every person across the organisation.

Teams work from the same customer data, track the same conversations, and act with the same confidence. Because every task can flow freely and transparently.

Salesforce transforms the way insurers think, operate, and grow. It automates manual tasks and provides intelligent insights for decision-making processes in organisations. Claims are processed seamlessly.

Agents spend their time building relationships instead of hunting down updates. Managers are confident making decisions based on live insights instead of assumptions. Salesforce customer 360 for insurance morphs into the digital core that runs agility, speed, and precision redefining traditional insurers into a truly intelligent enterprise.

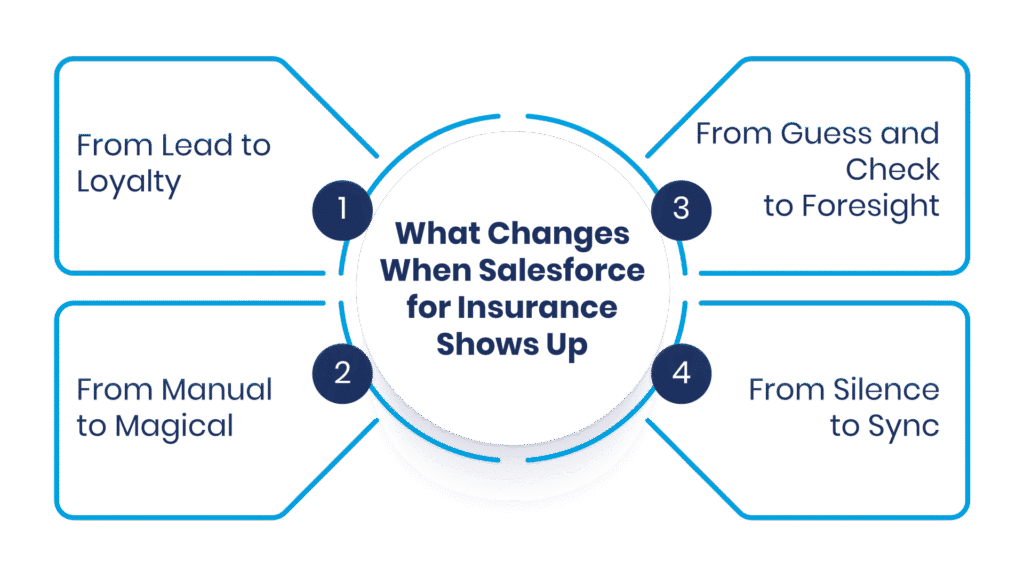

What Changes When Salesforce for Insurance Shows Up

When insurers go digital, Salesforce for Insurance Industry begins to create a ripple effect that engages every piece of the business. What starts as a system upgrade quickly evolves into a complete change of culture. Teams stop working in the silo. Data starts driving decisions.

Every interaction with customers is enriched with meaning and context. What starts small builds into an observable impact, one process at a time. One agent at a time. One policy at a time.

From Lead to Loyalty: Salesforce allows agents to engage with prospects in ways other than cold calling. Agents are aware of when and why the prospect has intent for each interaction. Overall, intelligent insights drive every interaction, allowing agents to seamlessly transition leads into loyal customers.

From Manual to Magical: Automation displaces tedious and time-consuming tasks. Renewals, updates on claims, or tracking a policy happen now and again without humans being involved.

From Guess and Check to Foresight: Using predictive analytics, insurers now know who might renew, who might become a full customer, and who might switch, or even if they get an email from a rep near their renewal date. Teams are empowered to act confidently and not based on assumptions.

From Silence to Sync: Communication is no longer lost when handed off. Each agent, broker, and underwriter now aligns on the same platform. There is no effort to work together; the customer feels the result through faster and smarter service.

Data Now as the New Currency in Insurance

Within each insurer’s operation, Salesforce for Insurance Industry harnesses raw data and turns it into pure business power. It collects and pulls data from every claim, from every policy, and from every customer interaction.

It connects the data into one cohesive picture that drives better decision-making. Agents no longer guess what their customers want. Professionally, managers are data-informed decisions.” They manage performance, learn behaviour, and anticipate outcomes before the outcome worsens.

Data has quickly become the true currency of growth. Clean and connected data sources enable faster claims, more accurate risk assessments, and improved product recommendations.

With Salesforce for the Insurance Industry, insurers migrate from reactive service to predictive strategy. Every click, call, or claim is data that adds intelligence to the system, adding up over time to become the competitive advantage and invisible engine that drives trust, accuracy, and profitability.

Restoring Trust in a Digital Age with Salesforce Insurance

In an age of screens and automation, Salesforce for Insurance Industry restores the personal touch to the human relationship in each and every incident. No longer are customers just numbers but unique individuals with their own wants or needs and emotions.

Agents see the full story for each customer like history, preferences, and needs. In particular, each notice/reminder/claim feels personal and in the moment. Customers feel feelings of being heard, acknowledged, and valued.

Technology builds relationships instead of eliminating relationships. Automated journeys handle the mundane, allowing human agents to focus on empathy and trust. Salesforce for the Insurance Industry puts the focus on compassion, providing reassurance at a time of uncertainty and care for the customer in the claims process.

Insurance carriers are no longer product sellers but rather lifelong relationship builders through engagement that matters. In this digital age, trust is the most robust policy they can sell, and it continues to be what holds insurance companies to you.

The Future is AI, Risk Intelligence, Hyperpersonalisation

As the insurance industry participates in a journey to evolve, Salesforce for Insurance Industry is moving insurers toward a more intelligent and predictive future. Artificial intelligence is already transforming how teams review risk and price policies and engage with customers and clients.

Every insurance company can now make decisions based on data versus assumptions. AI reviews claims, customer needs, and data to establish any patterns for the insurer to respond quickly with accuracy. Risk intelligence will replace any gut feeling and offer executives confidence in making decisions to move forward.

Hyperpersonalization will create experiences customers are always looking for. Salesforce for the Insurance Industry empowers insurers to provide offers, alerts, and updates tailored for their customer’s life stage. It does not just feel as if every engagement is intentional.

According to hyperpersonalisation, an insurer does not react to customer needs; an insurer anticipates needs with Salesforce customer 360 for insurance. The future can only be as intelligent, adaptive, and engaging as its definition.

The conclusion – The Transformation of Insurers into Intelligent Organisations

When insurers choose innovation, Salesforce for Insurance Industry will change them into intelligent, predictive organisations. They do not just sell policies anymore; they thrive in ecosystems, understanding their customer needs before the needs arise.

Every claim, every renewal, and every conversation is now a platform for insight. Every action is now smarter and faster. Teams are now predicting instead of reacting. This evolution changes the identity of insurers from process-heavy organisations to customer-obsessed organisations of intelligence.

Shift from protection to prediction. Salesforce for Insurance Industry provides different tools for insurers to predict risks, custom solutions, and improve trust at scale. The future belongs to those who think ahead, act with precision, and lead with data-driven insights. Insurance is not just covering risk any longer; it is predicting it. Salesforce profits insurers the superpower to do exactly that. Lets get connected with Our Insurance Experts.

FAQs

In what ways does Salesforce for the Insurance Industry enhance the operations of insurers?

Salesforce for the Insurance Industry assists insurers to integrate every aspect of their business. It combines data from policies, claims, and customer engagements in a single platform. Teams can benefit from real-time analytics, workflow automation, and streamlined communications. A digital environment allows for processes to be completed quickly and accurately without manual interventions.

Why do insurers choose Salesforce and Salesforce for the Insurance Industry instead of traditional CRM systems?

Traditional CRM systems only serve as storage for data. Salesforce for the Insurance Industry enables you to build intelligence around the data. Additionally, it creates automation, artificial intelligence (AI), and analytics that allow insurers to make real-time data-based decisions. The platform supports all operations from sales to service, creating a fully digital platform, not just simply a tracking solution.

In what ways does Salesforce better the customer experience in the insurance industry?

Salesforce for the Insurance Industry creates a complete view of each customer’s journey for agents. Real-time learning enables agents to identify their needs, preferences and concerns. The system can automate communications appropriately so the customers receive updates and notifications with their own tailored offers, for example, so that insurers have and build trust and loyalty from their clients for the future.

Does Salesforce for the Insurance Industry indeed have the ability to improve the speed of the claim process?

It certainly does. Salesforce will automate virtually every step of tracking and managing documentation and approval flows in a claim process. Therefore, agents are able to view at a glance the status of each separate claim and promptly address any issues that arise without wasting time. The resolution of claims is much quicker, and customers are more educated as to what is happening. With the power of these automations in place, delays are markedly shorter when adopting this versatile platform, and customer satisfaction is substantially increased.

In what way does Salesforce for the insurance industry prepare insurers for tomorrow?

Salesforce for the Insurance Industry will put artificial intelligence, predictive analytics and automation in a single solution. This allows insurers to understand when a risk may occur or has occurred, personalise services, and create intelligent products.

With these advancements insurers can adapt to ongoing changes in the marketplace and learn to meet customer demands. Insurers will go from traditional firms to intelligent-level, data-driven organisations.

For more insights, updates, and expert tips, follow us on LinkedIn.