Step-by-Step Overview of Salesforce GST Portal Integration for Enterprises

It is becoming crucial for the businesses to ensure the security and authenticity of their customers in this highly evolving digital landscape. For those businesses who are operating across multiple regions in India and are actively handling a large number of customers, Salesforce GST portal integration proves to be a powerful asset.

Using this advanced technology from a solution like IdentryX, enterprises are able to seamlessly verify GST details, automate compliance checks, and maintain accurate customer records directly within Salesforce.

This GST KYC integration within CRM enhances the trust and mitigates the risks of frauds along with streamlining the onboarding process. As a result, businesses become more efficient, compliant with regulatory requirements, and deliver a topnotch customer experience. The workflow becomes simpler, frictionless, and easier while eliminating confusions and enabling teams to focus on growth rather than compliance hurdles.

Why is the Salesforce GST Portal Integration Essential for Enterprises?

Enterprises that are operating on a scale often face a challenge of GST compliance. It becomes very difficult to manually verify the GST number while using various tools and compiling them altogether. This can lead to fragmented systems, delayed operations, and errors. Moreover, there is an increased risk of facing financial penalties and operational inefficiencies.

The increased digitalization and AI have evidently transformed the way businesses perform by saving time, automating tasks, and minimizing errors. However, these also have increased the tendency of frauds and scams.

There are many cases reported where fake IDs are made using AI platforms enabling cybercriminals to bypass traditional verification methods. It is a matter of concern for those businesses which deal with sensitive financial and compliance data.

In such a scenario, Salesforce GST integration becomes essential. With real-time GST verification and automated compliance checks, businesses can confirm the authenticity of customer and vendor identities, causing major reduction in fraudulent activities.

This not only strengthens trust with clients but also ensures that operations remain secure, compliant, and efficient despite the increasing sophistication of digital fraud. It has been noted that solutions like IdentryX can reduce fraud by nearly 70% making it an ideal and a reliable solution for enterprises managing large-scale customer data.

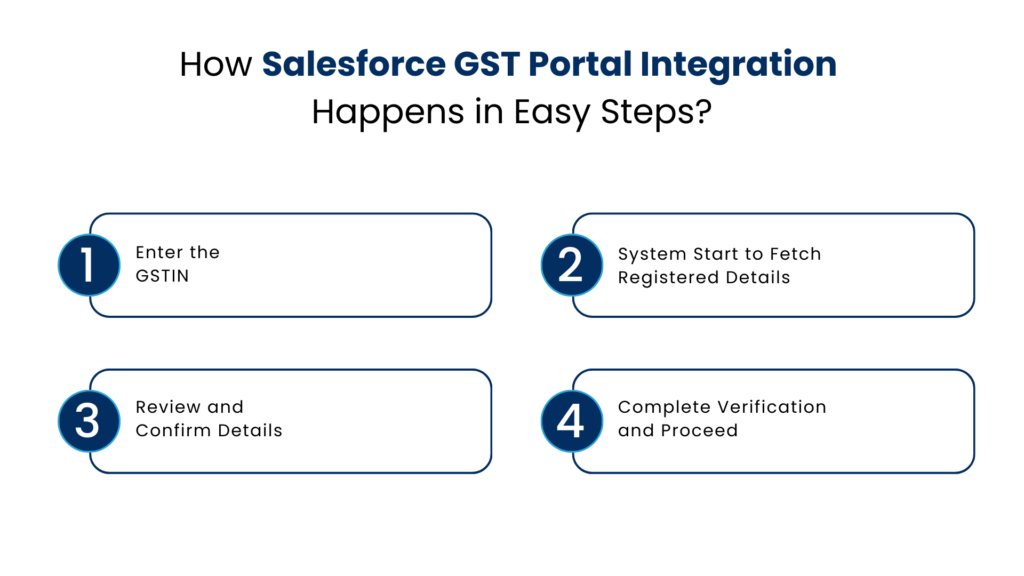

See How Salesforce GST Portal Integration Happens in Easy Steps

IdentryX simplifies the complex process of GST verification for a company handling large numbers of customers. It seamlessly integrates GST verification within Salesforce using 4 steps. This automated workflow allows businesses to validate GST details in real time without switching to some other platform other than salesforce. As a result, accuracy, compliance, and fraud prevention are ensured at every stage.

Step 1: Enter the GSTIN

The integration starts when a business enters the Goods and Services Tax Identification Number (GSTIN) of the vendor or customer into the verification pop-up panel in salesforce CRM. After this, it is required to click the “Verify” button to initiate the validation process.

Step 2: System Start to Fetch Registered Details

After clicking the “Verify” button, the system starts fetching the details associated with the entered GSTIN. If the number is valid, the details of owner, business name, company details, and past activity are included in those fetched details.

Step 3: Review and Confirm Details

The fetched GST details are displayed for review and cross-verification with the customer or business owner. This step helps companies and agents validate the accuracy of the information, ensuring the GSTIN is correctly linked to the respective entity and reducing the risk of incorrect or fraudulent registrations.

Step 4: Complete Verification and Proceed

After the verification and confirmation of details, next steps in the workflow are followed. This makes sure that no fraud activities occur in the system and each GSTIN is uniquely associated with a single entity. It significantly reduces the risk of fraud and prevents duplicate registrations.

Benefits of Salesforce GST Portal Integration for Modern Businesses

There are numerous benefits that businesses gain from salesforce GST number verification, including:

- Automation in workflows: Salesforce GST Portal integration significantly reduces manual data entry by automating the GST validation process directly within the CRM. Now, companies do not need to switch between multiple platforms. The result is saved time and minimum errors.

- Real-Time Validation: With real-time GST verification, businesses can instantly confirm the authenticity and status of a GSTIN at the point of onboarding or transaction processing. This ensures accurate tax reporting and prevents invalid or inactive GST numbers from entering the system.

- Enhanced Compliance: Salesforce-GST KYC integration allows the internal processes of a business to align with GST regulations. This modern solution helps prevent compliance gaps, reduces the risk of penalties, and supports regulatory adherence.

- Operational Efficiency: Salesforce GST number verification streamlines key business processes such as customer onboarding, invoice creation, and GST return preparation. Automated verification accelerates workflows, allowing teams to process transactions faster and more efficiently.

- Improved Customer Experience: Enterprises that Integrate Salesforce with GST observe a streamlined flow of key business processes such as customer onboarding, invoice creation, and GST return preparation. Automated verification accelerates workflows, allowing teams to process transactions faster and more efficiently.

When the GST KYC verification process occurs within the CRM, compliance becomes an embedded part of daily operations rather than a separate task. Automation in workflows handles the regulatory requirements so that team members can focus better on strategic growth and business performance.

IdentryX : A Topnotch KYC Solution for GST Verification

- An easy-to-use solution that seamlessly gets integrated with current salesforce and does not disturb the ongoing workflow.

- It provides real time GSTIN data and tells if the number is valid and active at the latest time.

- It has a simple and intuitive interface so that there is no confusion or difficulty while using it.

- Frauds are immediately detected with AI and are reported to the management and customers instantly.

Conclusion

In this AI-powered and digitally dominant business world where frauds are occurring repetitively, a service that automatically regulates compliance is required. Which is why Salesforce GST portal integration has become a critical asset for the companies that manage large customer bases across India.

This powerful integration enables real-time GST validation and centralizes compliance data to help businesses save time, reduce errors, and enhance operational efficiency. Out of many solutions available in the market, IdentryX is a trusted GST KYC solution that reduces fraud by nearly 70% & ensures accuracy and faster KYC procedures by 80%.

FAQs

Why do enterprises need Salesforce GST portal integration?

Enterprises often face complex GST compliance requirements. Salesforce GST integration helps to automate verification, reduce errors, prevent frauds, and ensure consistent regulatory compliance at scale.

How does GST KYC verification work within Salesforce?

GST verification within Salesforce begins by entering a GSTIN into the CRM. Then, registered details are fetched from official records, displayed for review, and allows businesses to verify and confirm the information before proceeding with onboarding or transactions.

How does IdentryX enhance Salesforce GST portal integration?

IdentryX acts as a GST KYC Verification solution that seamlessly integrates with Salesforce. It enables real-time GST verification, reduces fraud, improves accuracy, and accelerates compliance workflows for enterprises.

How long does it take to implement Salesforce GST portal integration?

The implementation time depends on business requirements and system complexity. However, with the help of IdentryX, integration can be completed quickly with minimal disruption to existing CRM.

For more insights, updates, and expert tips, follow us on LinkedIn.