Why Are Financial Advisors Choosing To Use Salesforce Financial Services Cloud?

The financial services sector is changing faster than ever. Technology, automation, and changing client needs are all changing the way advisors engage, communicate, and provide value.

In this changing landscape, Salesforce Financial Services Cloud helps advisors keep ahead of the field by providing intelligent tools to simplify client management and improve engagement.

It empowers advisors to manage their client relationships, monitor performance in real time, and make unencumbered decisions without running multiple systems.

Today’s financial professionals need more than data; they need insight, agility, and personalisation. Salesforce Financial Services Cloud accomplishes this, enabling every client interaction, financial goal, and relationship insight to be successively captured in one unified platform.

This connected ecosystem allows advisors to provide personalised experiences, create trust faster, and add new clients to their portfolios quickly and efficiently.

The Growing Challenges Financial Advisors Face Today

As the financial services industry becomes more competitive and client expectations grow, financial advisors are increasingly challenged to manage operational and client management complexities.

With this pressure, Salesforce Financial Services Cloud provides qualified support as advisors try to manage client data and compliance tasks and provide personalised service, all while managing their daily workload. Advisors need engagement tools that simplify processes and clarify every client engagement, each and every time.

Advisors also experience fragmented systems, delayed intelligence, and time-consuming manual processes. These problems reduce productivity and affect the client’s experience.

When advisors have access to intelligent technologies that allow them to have greater access, visibility, and capacity to manage their processes, it allows them to place most of their energy into building solid relationships and reducing, if not eliminating, spreadsheets.

It is the connected platform that allows for a streamlined experience at every step from the onboarding experience to the management of the portfolio, helping advisors to work faster with clients and directly supporting their journey/progression.

What Differentiates Salesforce Financial Services Cloud

Financial advisors are looking for products that provide a way to work smarter rather than harder. Salesforce for Financial Services is a platform that connects every study of client management in a single environment.

It incorporates data, intelligence, and workflow, allowing for the precision and speed in managing the cross-functional nature of relationships. Client goals can be tracked, portfolio performance can be monitored, and client engagement can take shape with a single view.

What really differentiates us is our personalisation to customize and use automation capabilities. The technology gives greater penetration into client needs and acts instantly.

It reduces complexities/delays in the financial process by not only automating many of the repetitive items but also giving that time back to the advisor to have quality conversations with clients and develop strategic planning.

Salesforce for Financial Services enables them to transform data into action, relationships into trust, and goals into measurable results.

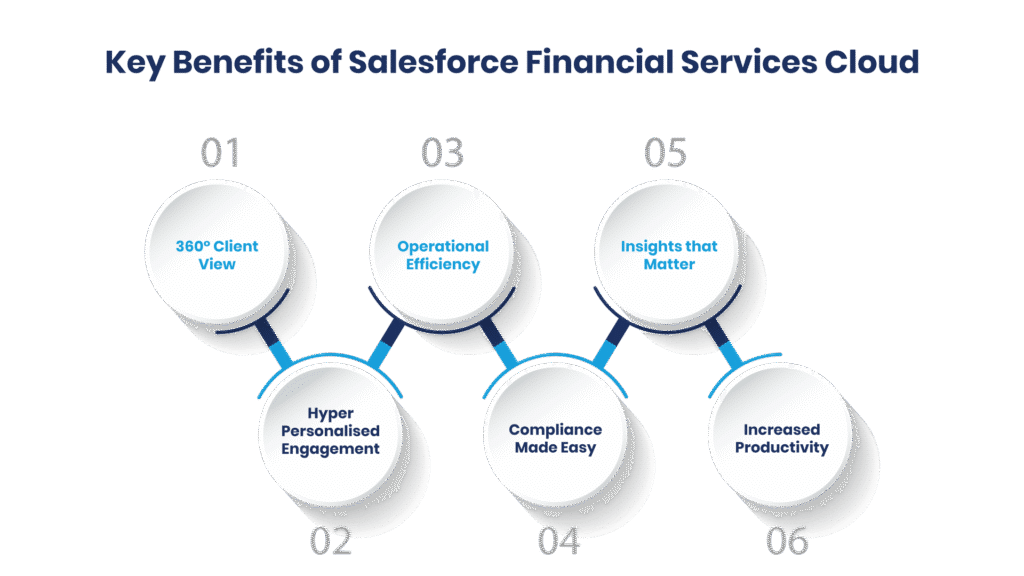

Key Benefits of Salesforce Financial Services Cloud

Financial advisors are always looking to deliver more value, save time, and deepen client relationships. The Salesforce for Financial Services enables advisors to optimize their workflows to spend time on what matters most to their client’s success. It combines intelligent insights, automation, and collaboration tools to help advisors scale their business quickly and efficiently.

360° Client View

The advisors get a complete view of their client’s financial life with Salesforce for Financial Services. Advisors can organise all the client’s assets, liabilities, goals, and past meetings and discussions on a single dashboard.

Once financial life is visible, the advisor can identify trends, predict behaviour, and deliver great advice. The advisor builds stronger relationships with clients and creates a genuine experience that is consistent with the client’s goals.

Hyper-Personalised Engagement

They can quickly provide each client with hyper-personalised recommendations when advisors leverage Salesforce for Financial Services. The advisors track life event changes, investment milestones, and shifting financial objectives to offer meaningful advice relevant to each client in real time.

Hyper-personalised engagement fosters a deeper trust between client and advisor, which creates lifelong loyalty. Clients feel heard, understood, valued, and supported on their financial journey.

Operational Efficiency

The advisors can facilitate automating tasks and processes when using Salesforce for Financial Services to create operational efficiencies.

Many of the processes that take excessive amounts of time, such as onboarding clients, generating documentation for clients, and reporting, can be completed in a streamlined and efficient manner, with limited engagement in the process by the advisor.

Advisors can use this automation to spend more time on strategic financial planning and engaging with their clients. Advisors benefit from improved workflows that also save the firm time, enhance accuracy, and boost collaboration between departments.

Compliance Made Easy

Built-in capabilities allow advisors to be across, setting them up for success in meeting the regulatory requirements of their practice without impacting their workflows or ability to manage audits.

Insights that Matter

Data-driven dashboards provide advisors with the insights they need to make swift, informed decisions to improve performance and client satisfaction.

Increased Productivity

By integrating everything, collaboration among advisors is easier, responses are faster, and results are quantifiable.

Reasons Advisors Move to Salesforce Financial Services Cloud

Financial advisors seek technology that will help simplify their work process while improving client satisfaction. For advisors, Salesforce for Financial Services offers the capability to manage each and every client relationship more quickly, accurately, and insightfully than ever before.

Advisors see real value in its ability to connect the valuable data they have available, automate various important processes, and create a better client experience. It allows them to bring together various disconnected tools into one single intelligent platform to facilitate growth at every stage of the advisory interaction.

Advisors transition because they want measurable results. They experience faster client onboarding and improved retention, and they become more efficient in their daily operations because of it.

With the Salesforce for Financial Services, advisors can immediately convert what they see into actions that build trust and deliver improved results. It changes the way advisors can provide service completely, with the use of smarter service, leaner operations, and deeper client connections.

Conclusion

As financial advisors grow to meet changing client expectations and market pressures, Salesforce Financial Services Cloud helps them deliver smarter, faster, and more personalized financial experiences. Advisors can provide the level of service clients increasingly expect for each and every client.

The platform brings together every client interaction, insight, and opportunity into one connected system. Advisors can leverage this to strengthen relationships, improve efficiency, and achieve measurable results.

It’s time to rethink how you manage your client relationships and financial goals. Learn how Salesforce for Financial Services can change your advisory practice. It can support your continued success and move your growth to the next level. Reach out to Manras Technologies today.

FAQs

What is Salesforce Financial Services Cloud?

Salesforce Financial Services is a purposeful CRM platform for financial advisors that enables them to manage multiple client relationships, portfolios, and financial goals through an integrated and intelligent solution.

How does Salesforce Financial Services assist financial advisors?

The Financial Services Cloud helps advisors simplify client management. It automates workflows and provides real-time insights. Advisors can use these insights to offer more customized services. The platform also enables them to build stronger relationships with clients.

Does Salesforce Financial Services enhance client engagement?

Yes, Salesforce Financial Services delivers a 360° view of each client to advisors, so they can engage in a timely manner and personalise communication to build trust and deepen client engagement.

Why are financial advisors migrating to Salesforce Financial Services?

Advisors migrate to this option to improve their processes. They achieve more efficient operations and reduce the need for manual workflows. They also grow their business by leveraging data-informed insights.

How can Manras Technologies assist with Salesforce Financial Services deployment?

Manras Technologies assists businesses in deploying Salesforce Financial Services. We help customize the platform to fit the advisory processes of your firm. We also optimize the solution to support your growth goals effectively.

For more insights, updates, and expert tips, follow us on LinkedIn.