How Can Salesforce Automate Identity Verification (KYC) Without Errors in India?

Businesses in India depend on precise identity verification to keep fraud at bay, so as part of fortifying the process, they implement Salesforce automated kyc verification in india. Besides meeting compliance requirements, companies also need trustworthy verification in order to establish trust with each new customer.

Manual inspections drag the team’s performance. They add up errors because the team members have to switch between tools. At the same time, the team gets more confused because the records are scattered across different systems. These problems cause delays and raise the number of rejections.

Salesforce provides a common ground for companies to solve these problems. It is a platform that attracts customer data, verification stages, and automated workflows all together. Identryx powers up this integration. It is a Salesforce app that fully automates identity verification.

It helps the team to do document verification in a flash. Also, it makes the entire KYC process very simple and at the same time accurate and consistent in results.

What Is Identryx & How It Integrates with Salesforce?

Departments stare identity verification in the face every day, and in the middle of that operation, they employ Salesforce automated KYC verification to keep the accuracy intact. Identryx is there to provide that support through a single, comprehensive identity-verification solution within Salesforce. It helps companies to verify documents, confirm details of customers, and perform KYC procedures without leaving the CRM.

Identryx combines compliance, onboarding, and verification in a single place. It avoids the necessity to constantly change different tools. Also, every step is kept consistent because it associates all the verification actions with the customer record.

The procedure is still uncomplicated. A lead or a customer comes to Salesforce. Identryx immediately initiates verification. The system verifies documents and customer details. Then it delivers the verification results straight to the Salesforce record. Such a flow keeps the team up to date and allows them to proceed with customers’ onboarding at a quicker pace and with full transparency.

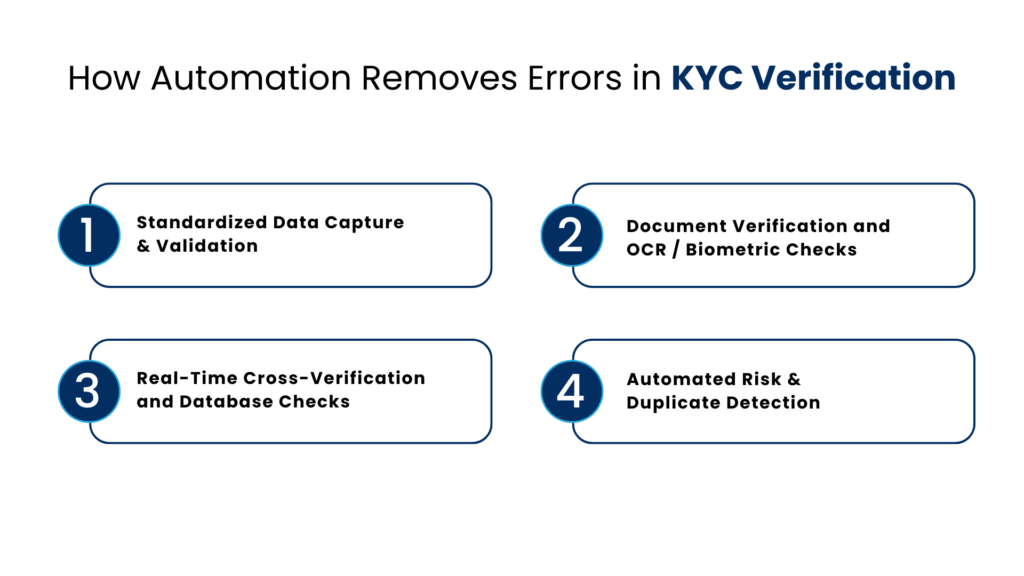

How Automation Removes Errors in KYC Verification in India?

Accuracy can be raised by a team if they use smart instruments properly and in such a scenario, they cannot do without Salesforce automated kyc verification in India, which is the central element of their workflow for the complete eradication of mistakes. Automation abolishes manual steps. It does away with the problem of confusing the parts. Also, it provides the team with more clean data and gives them the verification outcomes in a much shorter time.

1. Standardized Data Capture & Validation

By using guided forms, the team gets the right data capturing approach. With the predefined fields, the information becomes more uniform. These measures lessen the number of typos. They also stop the errors of the formatting. In addition, they make sure that there is no lack of details which cause the verification process to be slower.

2. Document Verification and OCR / Biometric Checks

Instrumental document verification accelerates the process of identity. Using OCR the system is able to read such documents as ID cards, passports, and driving licenses. It gets the details needed at once. The logic that is built in the check is there to confirm the origin of the document. Before the documents get into the onboarding flow, it finds those that are tampered with and forged.

3. Real-Time Cross-Verification and Database Checks

Automation does the real-time cross-verification of the data. It verifies the names, birthdates, and addresses with the help of trustworthy databases. It is the validation occasion in which they do it the very moment the customer offers the data. The procedure helps the team to locate the points of divergence at the earliest stage.

4. Automated Risk & Duplicate Detection

As soon as they are possible, the system spots duplicates and puts them in the spotlight. Based on risk rules, it highlights those that are suspicious. Not only does it keep customer records neat and unique but also it stops fraudulent identities from proceeding to the later stages.

How Salesforce + Identryx Improves Onboarding Speed and Compliance?

Organizations are looking for ways to accelerate the onboarding process while maintaining accuracy and compliance, thus in the middle of this procedure they employ Salesforce automated kyc verification.

The collaboration between Salesforce and Identryx in a country like India, results in the creation of a flawless flow of verification. They alleviate the wait time. Besides that, they maintain the cleanliness of records. Moreover, they give the support to the teams in the form of real-time insights at every stage.

1. Unified Customer Profiles & Seamless Audit Trail

Salesforce keeps KYC information, verification outcomes, and audit logs all together in one customer record. The arrangement that is in place here does away with the need for scattered spreadsheets. Besides, it makes every bit of information traceable. Also, it is very helpful in fulfilling the regulatory demands easily and comfortably.

2. Triggered Workflows and Automated Follow-ups

The work of onboarding is continued by Salesforce when the verification is successful. Problems are signaled by it on the spot. Besides that, it requests customers to send their documents if they are obliged to do so. The automated steps that are in place inform the team members and thus help to avoid the lack of coordination or stopping points in the process.

3. Consistent Customer Experience and Reduced Drop-offs

Consumers provide documents via online forms or portals. They do not have to enter data that is already there again. Additionally, they get notifications in a timely manner that are directly connected with CRM workflows. The clearness that is brought by this method lowers the number of drop-offs and makes the level of customer satisfaction higher during the onboarding process.

Key Benefits of Salesforce Automated KYC Verification Tool like Identryx

The team fortifies their onboarding process and in doing so they enhance the accuracy and control by employing Salesforce automated kyc verification at the midpoint of that journey. Automation makes every verification step easy. It provides the team with clean data. Besides that, it does not stop the customers from moving forward in the absence of a time gap further.

The practice of onboarding more quickly is gradually establishing itself as the standard because the entire operation of data checking is done by the system right away.

Error-making is lowered since the workflow eradicates manual entry and inconsistent validation.

On top of that, compliance gets better since each verification step can still be traced and logged.

The system quickly flags people who try to fake their identity or use incorrect information, which reduces the risk of fraud. It stores all customer and verification data in one place, helping team members manage records with clarity and confidence.

Possible Challenges & How to Overcome Them

The group has to overcome many obstacles while carrying out the verification and in the midst of that they employ Salesforce automated kyc verification to lessen those difficulties. However, they still require thorough preparation if they are to avert problems and maintain a smooth flow of work.

The team handles data privacy with great care. They store sensitive documents in a secure way. They also follow industry rules for Salesforce KYC management. Further, they restrict access and allow only authorized members to view or use the documents.

On the other hand, the integration part needs the right preparations. If the team members set up the KYC plugin, custom fields, and workflows in an organized manner then they will be able to smoothly go live after having tested each step.

Customer friction is a problem that arises when users have difficulty uploading. By providing clear instructions users will be able to submit documents without any problems. Offering simple upload options that are mobile-friendly will help to enhance users’ experience.

There can still be exceptions besides fallbacks. The team is setting up fallback procedures for manual checks. They deal with the flagged entries by conducting their quick review thereby ensuring that onboarding is still going.

Conclusion

Businesses in India improve accuracy and speed when they implement Salesforce automated KYC verification as a key tool in their onboarding process. Correcting which automation greatly reduces,also the mistakes by accelerating verifications and making compliance more robust with every customer engagement as well.

The cooperation of Salesforce and Identryx puts identity checks and CRM data in the same platform. This arrangement simplifies the workings of the company. It strengthens trust as a result of teams having well-verified information at their disposal at all times. Customers get improved onboarding journeys while businesses secure their verification processes.

Faster, cleaner, and more reliable Salesforce kyc management is a must for any business in India that is on the rise. By means of automated verification, such companies can still be efficient and customer oriented. Besides, it escalates them to the level where they are capable of meeting future compliance requirements.

Start your journey today. Explore automated KYC inside Salesforce and unlock a smarter, safer onboarding experience.

FAQs

How does Salesforce help businesses automate KYC without errors?

Salesforce empowers KYC automation by gathering all client data and verification measures in one place. Every step of the operation is linked to a single workflow. It minimizes the manual labor and eliminates the discrepancies. Moreover, it shows the verification results in live mode.

What role does Identryx play in the KYC process inside Salesforce?

Identryx performs identity verification directly within the Salesforce environment. It extracts information from the documents, verifies the customer’s identity, and consequently changes the status of the authentication. By doing so, it assists the team in continuity and engagement.

How does Salesforce automated kyc verification improve onboarding speed?

The system completes inspections quickly because it handles data entry, document checks, and validations automatically. It alerts teams about issues immediately. It also guides clients with clear steps and instant notifications, which helps them complete transactions with confidence.

How does automation reduce fraud and compliance risks?

Automated detection of fraud attempts gets the preventive measures ready at an early stage. It matches the identity data with trustworthy resources. Besides, it leaves detailed records of the activities performed, and thus the firms can stay in line with the compliance regulations and be audit-ready.

Why should businesses shift from manual KYC to automated KYC inside Salesforce?

Manual verification dramatically slows down the onboarding process and gives room for errors. Automation KYC solutions make the work not just accurate but also quicker and consistent. They also offer firms a complete picture of their clients and the verification history. The transparency from that leads to better decisions and a safer onboarding journey.

For more insights, updates, and expert tips, follow us on LinkedIn.