The Hidden Power of Salesforce Every Financial Firm Should Tap

Financial firms are leveraging Salesforce financial services to power business, but more crucial than technology adoption is change on a systemic level. Customers simply don’t have any tolerance for cookie-cutting; customers expect planners to know what they’re doing before having to say a word, provide extensively customized solutions, and provide solutions in real-time.

Salesforce as a data warehouse is utilized by organizations that expose them to losing the higher-order value of client insight and workflow automation.

Real technical finance triumph belongs to technology and strategy and technical players. Advisors need to use insight, not dashboards, to steer the conversation and build trust.

Compliance teams need to use automation to break risk into its constituent parts and give strategy more space. Executives need to tap Salesforce as a growth driver, not an app of record.

Successful firms and industry leaders are quantified by delivery. Visionary leadership is predicated on the unleashed potential of Salesforce to connect customer journeys, provide teams predictive vision, and create trustful customers. They who wed technology and vision-driven strategy thrive, while the rest are madly playing catch-up with yesterday’s processes.

The Changing Financial Services Landscape

Banks must navigate the tightrope of continuous disruption, and Salesforce financial services assist them in enduring the strictures imposed by their customers.

Clients now want quick responses, tailored advice, and smooth experiences on every channel they use. Process-oriented methods and aged company silos can’t handle it.

Technology is not an add-on anymore but a force multiplier in the way in which the financial institutions compete and innovate.

The advisers are all sharing the common data while hunting for the customers, and automation scares off duplicate efforts that would cause wastage of productive time. The companies that are successful with this change are providing differentiated experiences and increased loyalty among the customers.

Competition becomes more intense with players of the local heritage entering the battleground with speed and innovation. Heritage players, if they are not provided with access to digital, get discredited.

A connected platform enables banks to become fast, become credible, and pre-generate customer demand. Disruption best fits risk-taking companies in between, who go out and get rewarded, and companies that get bogged down by heritage.

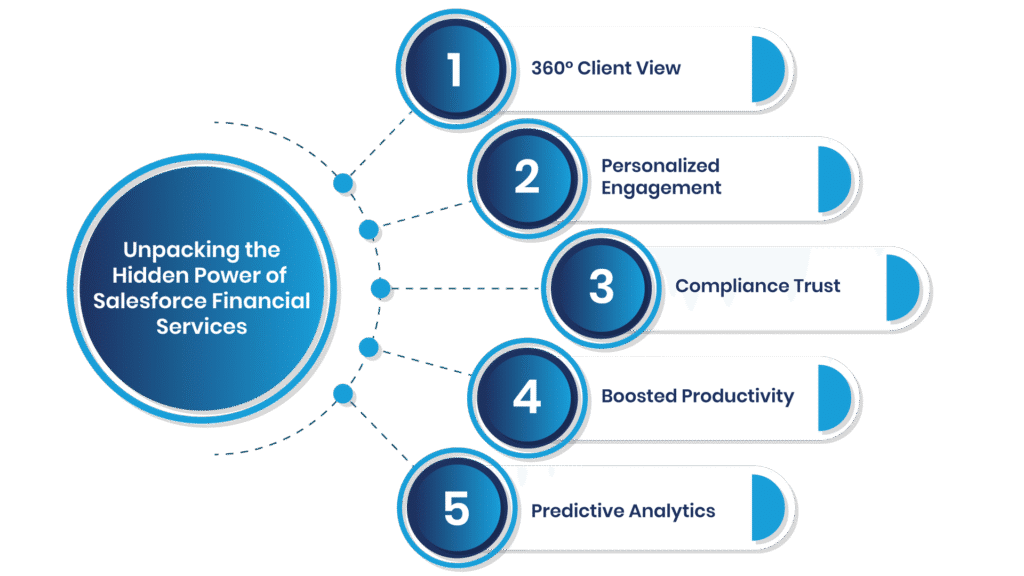

Unpacking the Hidden Power of Salesforce Financial

Services

Organizations discover utmost value when Salesforce financial services is no longer a typical CRM but an actual change platform. The magic is not in the data warehousing but in the way the platform transforms data to insight, to activity, and ultimately to more enduring customer relationships.

360° Client View

Salesforce brings the three sources of investments, banks, and insurance under a one-stop-shop solution. Advisors possess detailed profiles of clients, such as risk profile, financial objectives, and background. Advisors coach well within timelines openly.

Personalized Engagement

The technology will be backed by AI-driven intelligence, which will be able to anticipate client requirements and recommend bespoke solutions. Advisors turn up at the right moment with exactly the right offer, whether a loan, investment, or insurance solution. Personalization builds confidence and trust.

Compliance Trust

Salesforce automates routine paperwork, handles approvals, and tracks records, reducing mistakes and keeping firms compliant. Firms save time but remain up-to-date at the cost of abandoning industry regulation compliance.

Boosted Productivity

Streamlining day-to-day activities facilitates freeing more staff for contribution. Advisors free themselves from routine tasks and focus more on creating valuable client connections.

Predictive Analytics

Einstein AI gives insights that spot risks and opportunities before they appear. Companies make smarter decisions, secure their assets, and innovate in front of competitors.

Business Value of Salesforce for Financial Institutions

Banks and financial institutions experience massive growth when Salesforce financial services unifies client engagement, compliance, and productivity on a single platform. It’s not a destination portal; it reengineers customer-facing, internal, and competitive behavior for banks and financial institutions.

Seamless Client Onboarding

The Salesforce for financial services simplifies onboarding through automated channels and document-free support. Onboarding is simple for customers, and businesses avoid delay and human error.

Improved Client Retention

Tailor-made experience for the adviser side enhances trust and loyalty. Advisors proactively offer customer retention solutions.

Advisor Productivity Boost

Automation eliminates administration strain from the picture, freeing adviser time up for high-margin client engagement. Work is choreographed with a tidy ballet of groups; they share and advance opportunities at a faster rate.

Reduced Risk of Compliance

Built-in audit trails and compliance checks automatically eliminate errors. Businesses save overhead costs while staying fully aligned with regulations.

Revenue Boost

There are devious upsell and franchise opportunities that surface to the top by virtue of predictive analytics. Advisors gain the power to practice effectively, generate more revenue from existing clients, and onboard new customers with greater efficiency.

How to Unleash the Full Potential of Salesforce Financial Solutions

Firms truly unlock value in Salesforce finance features when they transition from adoption to strategic adoption. It is just not a case of consuming the system as a system of record but as a growth driver, as a productivity driver, and as tighter client relationships.

Assess Current Usage

Companies must check if they’re utilizing Salesforce as an analytics tool or a warehouse of customer data. A usage audit comes to find gaps and opportunity gaps.

Enable Financial Services Cloud

Salesforce for financial services delivers tailored solutions designed for banking, insurance, and wealth management. Companies gain industry-developed business processes, pre-built dashboards, and client-focused tools with faster insights.

Drive AI-Driven Insights

The Einstein AI turns raw data into predictive intelligence. The system designs recommendations and pushes them to advisors, helping them act on the most important opportunities and threats.

Empower and Train Teams

Tools create value only when people understand how to apply them. Role-based training teaches managers, advisors, and compliance staff how to use Salesforce well.

Work with Custom Solutions

Trusted partners help in shaping Salesforce for each business. They build simple automations, workflows, and tools so the system can match the goals and give the best results.

How Salesforce Financial Cloud is Changing Modern Finances

Companies can give better customer service when the Salesforce financial services cloud brings the data, automation, and AI together in one place. It allows financial institutions to respond faster and provide smarter solutions to their customers.

Personalized Client Journeys

The Financial Cloud gives every customer personalized guidance and offers. This personal touch builds trust. It also creates stronger relationships.

Intelligence-Powered Data Integration

It connects data from financial systems to enable advisors to deliver a single, unified picture of customers. Barriers are removed, allowing quick responses and improved decisions.

Fast Digital Onboarding

Automated document handling and workflows make onboarding fast and smooth. Businesses cut down costs and errors, while customers enjoy a quicker, hassle-free process.

Smarter Risk and Compliance Management

Financial Cloud comes with built-in compliance tools and audit trails that make it simple to follow regulations. This helps companies to reduce risks while working with transparency and accuracy.

Advisor Productivity Boost

Financial Cloud automates routine tasks, so advisors spend more time in real conversations with clients instead of wasting it on paperwork. Teams work in motivational harmony and provide a more productive client experience.

Past proof of innovation

With expectation and automation with AI, businesses are spearheading the revolution in the market. They are thinking ahead, responding first, and competing with a new order of the world.

Conclusion: From Hidden Potential to Competitive Advantage

Firms leave a lasting impact as Salesforce financial services transform from add-on tools to strategy drivers. The platform allows for more enduring relationships to be built by advisors, risk is governed by compliance teams, and growth is driven by leaders. Unleashed potential is a differentiator, but only if firms are using Salesforce as a transformation engine, not a CRM.

By linking information together, making it meaningful, and simplifying key processes, Salesforce turns challenges into opportunities. Companies that see this opportunity build stronger trust, improved retention, and quicker innovation. In a world where there are always shifting customer needs day by day, moving quickly and making the right decisions is what gets industry leaders in motion.

Are you prepared to maximize Salesforce and reshape how you engage with customers? Tap into experts who are Salesforce financial services certified and drive growth, confidence, and long-term value.

FAQs

Why are Salesforce financial services unique compared to a standard CRM?

Salesforce financial solutions is more than vanilla client information management with industry-specific banking, insurance, and wealth management functionality. It includes 360° client insight, predictive analytics, and compliance-driven business processes a vanilla CRM can never have.

How does Salesforce financial solutions transform client relationships?

The platform brings information together, and advisors are able to customize each interaction. AI-driven recommendation enables organizations to pre-plan in order to fulfill customer requirements and provide timely solutions, which ensure higher loyalty and trust. Employee engagement in processes reduces risk without constraining processes.

Is Salesforce for financial services compliance-enabled?

Yes. Salesforce simplifies rule management, ensures accurate documentation, and minimizes risks in reporting. Compliance direction integrated in processes reduces risk without constraining processes.

Does Salesforce financial solutions increase advisor productivity?

Yes. Automation does the heavy lifting so that the advisor has time to focus on high-margin client conversation. Teams save time and reduce complexity when using instant collaboration systems.

How do Salesforce financial solutions fuel business growth?

The platform is cross-sell and upsell predictive, maximizes customer retention, and maximizes onboarding. Companies use predictive analytics for more effective competitive advantage and revenue-driven decision-making in the market.

For more insights, updates, and expert tips, follow us on LinkedIn.