eKYC: Identity Verification Directly in Salesforce

In an increasingly digital first world like today, organizations are under constant pressure to verify the customer identities quickly, and keep the customer data secure and safe.

Additionally, it is important to remain compliant with the government laws and regulations. Identity verification no longer remains a back end function but has become mainstream. This is where the Identity Verification in Salesforce comes into picture.

Now, enabling a salesforce identity verification solution allows the businesses to streamline identity verification, reduce operational and data errors, and maintain all the customer data in a single space. Moreover, it allows the agents to make sure that one ID proof is mapped against just one person.

The eKYC solutions embed seamlessly in salesforce, reducing operational costs by almost 70% and the businesses can verify multiple identities at once. This ensures faster KYC verification in salesforce and leads to stronger customer relationships.

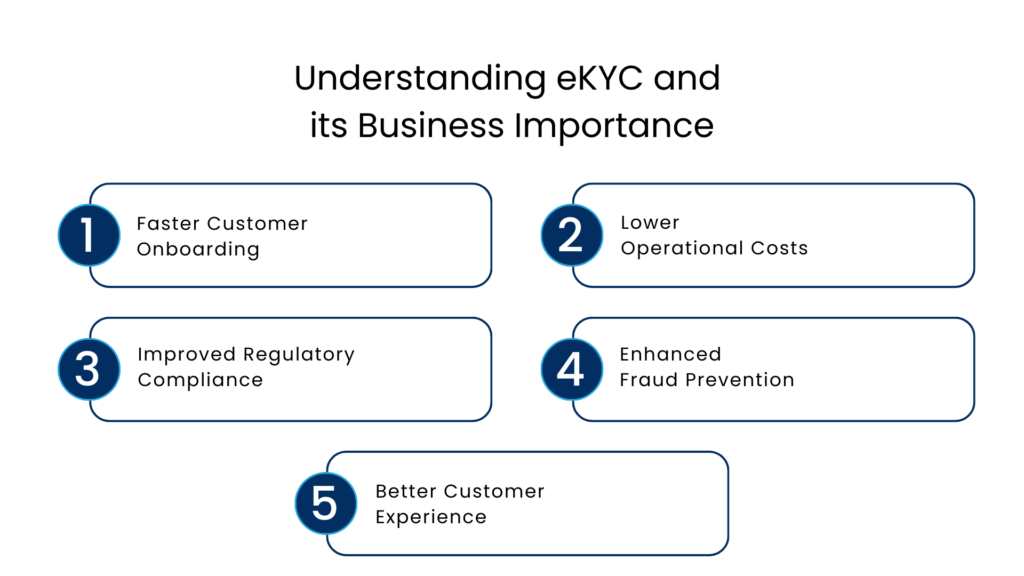

Understanding eKYC and its Business Importance

Electronic Know Your Customer or commonly known as eKYC is the digital process of verifying identities online through electronic means rather than physical document collection and processing. It typically involves collecting documents online, validating them and performing biometric checks, and screening against regulatory watchlists.

While the traditional KYC processes are slower and more error prone, requiring manual submission of documents and branch visits, the eKYC processes are simpler. The customer simply submits the documents in an online portal and this enables instant identity verification completed in a few minutes or seconds.

From a business perspective, especially in a country like India, the eKYC solution, IdentryX offers several benefits including faster onboarding process, lower operational costs, and enhanced fraud prevention.

Faster Customer Onboarding

An eKYC identity verification solution allows the businesses to onboard the customers faster, and the automation helps them cut down the account activation time, and reduce the drop off rates. This means that the businesses can onboard the customers at scale and grow faster.

Lower Operational Costs

With KYC being done online, the manual work is reduced. The customers submit their documents online and the verification also happens online reducing the scope of manual errors. When manual errors and work is reduced, the businesses and teams tend to perform better.

Improved Regulatory Compliance

The online KYC verification ensures that every identity that is being verified meets the rules and regulations set by the government in regards to KYC. It ensures that all the mandatory screenings are performed uniformly for every customer to avoid legal issues.

Enhanced Fraud Prevention

The chances of fraud are at the lowest when the KYC verification is done online. Since the system records every customer information as soon as it is received, which makes it easier for the agents to detect any multiple or fraud identities.

Better Customer Experience

When eKYC is enabled it makes the entire customer verification journey smooth. This avoids all the unnecessary friction, and saves the customers from filling out multiple and repetitive forms. This ensures that the customer identities are verified in a single flow without any disruptions.

Why Should You Bring eKYC-Identity Verification In Salesforce?

When identity verification happens outside of salesforce it creates data silos, duplicates, and mismanaged data. However, with identity verification in salesforce the data is available in a single CRM. This means that the documentation and customer records reside in the same space, making it easier for the agents to keep track of every customer.

Seamless Integrations

The digital KYC solution in salesforce, IdentryX, integrates seamlessly with the CRM and all the KYC related workflows are managed inside the CRM without any disruptions. The teams can initiate verification, track status, review results, and store compliance records without switching platforms.

OCR Enabled Technology

With the help of OCR identity verification in salesforce the agents get the most accurate results. OCR refers to Optical Character Recognition (OCR) which reads the text directly from the document like Aadhaar, PAN, and GST. This significantly reduces the manual data entry time and speeds up the verification process.

Verification From Multiple IDs

With the direct eKYC integration in salesforce, industries like finance, banking, real estate, healthcare, etc. can verify multiple identities at once. This not only helps the businesses, but also gives them the flexibility to submit different forms of ID based on region and availability. This again enables faster onboarding, verified results, and higher success rates. Moreover, it also helps in ensuring that the ID being verified is compliant as per the jurisdiction requirements.

70% Cheaper KYC Costs

The salesforce identity verification solution, IdentryX, significantly reduces the KYC processing costs by eliminating all manual work, review, and paperwork. By streamlining workflows online and automating the KYC procedures, the companies cut down their operational costs by almost 70% while maintaining accuracy, secrecy, and regulatory compliance.

AI Enabled Fraud Detection

With the digital KYC salesforce solution, the businesses get to leverage the true worth of AI. It uses liveness detection and matches the person’s face with the one in the identity proof while applying bio-metric anti spoof technology. This ensures that the person doing the KYC in real-time is the same as the one in ID. In case of any frauds, the technology will of course detect it and will report or blacklist it immediately to avoid legal consequences.

Enable Verified Digital Signatures

Document signing remains a critical part of the KYC verification process and for most businesses the fraud happens at this point. To reduce this, the salesforce identity verification solution allows the businesses to get the documents signed digitally via various methods like OTP, facial recognition, retina scan, and bio-metric. This strengthens the agents’ confidence in the customer, and once this digital print is added to the system with a verified certificate, it acts as a solid proof of the customer’s ID.

Conclusion

KYC verification process in India remains the most elaborate and the most important process to validate each customer in the database. But as digital advancements take over, manual processes do not matter and are time-consuming. Therefore, identity verification in salesforce via IdentryX has become the new norm. This eKYC enabled technology eliminates all the manual efforts and maintains all the customer KYC records in a unified dashboard.

Further, with one identity being mapped against one person and digital signature features, make this online KYC all the way more desirable. Agents onboard customers faster, reduce operational costs by 70%, and the AI enabled fraud detection helps the agents identify genuine clients. By improving the audit process for almost 95% of the businesses, this direct eKYC integration with salesforce is helping businesses scale, grow, and remain compliant with all the government norms.

FAQs

What are the methods of identity verification?

The five leading identity verification methods document, biometric, knowledge‑based, video, and database each balance security, compliance, and user experience differently. For enterprise‑grade assurance, automated document verification provides the highest accuracy (up to 99.9%) and lowest integration overhead.

What is the purpose of identity verification?

The main objective of identity verification systems is to prevent fraud and identity theft. Identity verification solutions are important for industries such as banking, financial, healthcare, and ecommerce. It is also important for other industries such as government, education, and non-profit organizations.

Is eKYC in Salesforce secure?

Yes, the eKYC in Salesforce is secure because it is built with enterprise-class security, encryption, access, and compliance. Customer data is stored securely, and all the verification processes are recorded.

How does Salesforce-based eKYC improve compliance?

The Salesforce-based eKYC system ensures that all regulatory requirements such as KYC, AML, and identity verification are uniformly applied for each customer. This helps businesses remain compliant with government regulations while making it easy to audit and report.

What is the role of digital signatures in eKYC?

Digital signatures provide an additional layer of assurance to the KYC process. Through OTP, biometric, or facial recognition methods, documents are signed and stored with verified certificates, thus minimizing the possibility of forgery or identity fraud.

For more insights, updates, and expert tips, follow us on LinkedIn.