How Does Aadhaar Based KYC Ensure Data Security & Compliance?

The digital economy for India is growing at a rapid rate and the businesses are under constant pressure to onboard customers faster and also maintain the standards of data security and regulatory compliance.

Know Your Customer (KYC) plays an important role in preventing fraud, money laundering, and identity theft. To perform the KYC processes, Aadhaar Based KYC has emerged as the most trusted source.

The KYC Software, IdentryX, blends seamlessly within the existing salesforce CRM and the agents are able to operate from a single screen. This way the agents get complete customer history with one identity mapped against the document. This ensures that no two users are mapped against a single identity, preventing frauds and ID thefts.

What Is Aadhaar Based KYC?

Aadhaar based KYC is a digital identity verification process that uses the Aadhaar number issued by the Unique Identification Authority of India (UIDAI) to verify and authenticate the individual’s identity. The process is aimed at verifying the customer’s name, address, date of birth, and biometric or OTP based authentication.

Unlike traditional KYC methods that rely on physical documents and manual verification, Aadhaar-based KYC is electronic, paperless, and near-instant, making it both cost-effective and highly reliable.

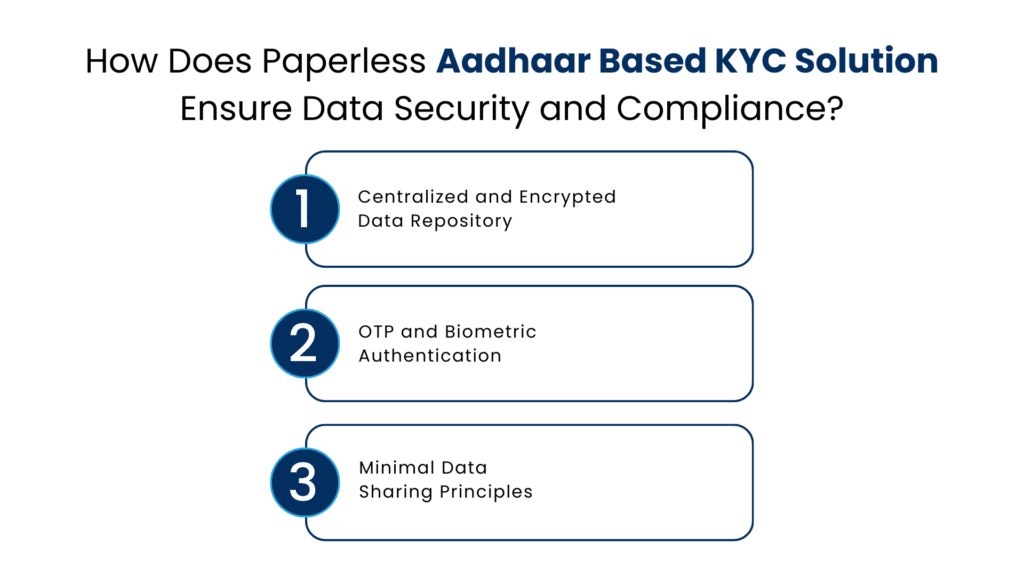

How Does Paperless Aadhaar Based KYC Solution Ensure Data Security and Compliance?

When the KYCs are done manually, especially in Aadhaar, it is easier for the agents to lose records and lose track of the customer data. This increases the risk of frauds and identity theft and without any online records, it is almost impossible for the companies to track the fraudsters and the customer data is lost.

Centralized and Encrypted Data Repository

The Aadhaar ecosystem is built on a highly secure, centralized database managed by UIDAI. All personal identity data stored within this system is protected using advanced encryption standards, ensuring that sensitive information remains unreadable to unauthorized entities.

During the KYC process, data is not freely shared. Instead, verification responses are transmitted through secure, encrypted channels, significantly reducing the risk of interception or data leaks.

OTP and Biometric Authentication

A key factor in Aadhaar Salesforce KYC security is its use of multi-factor authentication to verify an individual’s identity. Depending on the specific use case, authentication may be carried out through a One-Time Password (OTP) sent to the Aadhaar-linked mobile number or through biometric verification using fingerprints or iris scans.

These secure authentication methods ensure that only the legitimate Aadhaar holder can authorize the KYC request, significantly reducing the risk of impersonation, identity fraud, and unauthorized access.

Minimal Data Sharing Principles

Aadhaar-based KYC follows a data minimization approach, meaning only the necessary information required for verification is shared with requesting entities. Businesses do not receive access to the entire Aadhaar database; instead, they receive limited, consent-based identity attributes. This significantly lowers the risk of data misuse and aligns with modern data protection principles.

Why is Salesforce Aadhaar Identity Verification the Best Choice for Fraud Prevention in Indian Companies?

Aadhaar card is one of the most commonly used identity proofs in India and most companies rely on this for KYC purposes. However, a common challenge faced by these companies in traditional KYC is theft and fraud which often goes undetected. That is why the Salesforce based KYC aadhaar solution, IdentryX is the new choice.

This salesforce aadhaar KYC solution is paperless and allows the companies to verify identities faster and detect fraud at the beginning stages with the help of AI detection methods.

AI Based Fraud Detection

When companies rely on Aadhaar eKYC automation with Salesforce they get access to an AI system that is fully capable of detecting any fraud at the earliest stage, as soon as the ID is entered in the system. The system compares the individual’s face with the one in the ID and that is how frauds are prevented and the companies can take action instantly without any hassle.

Aadhaar Based Digital Signatures Within E-Mudhra

Getting documents signed physically is a big challenge and leads to fraud via forgery of signatures. However, when this happens digitally, the documents are signed digitally and the identity of the person doing the signature is verified either via OTP, bio-metrics, facial recognition or retina scan. Thai help is ensuring that the customer signing the document is the same as in the ID proof submitted.

One Customer to One ID

Maintaining the KYC records is a big challenge in India since physical presence with every document is mandatory, and that takes several days to be completed. Now when this is done in the salesforce solution for KYC verification, i.e., IdentryX, a single customer is mapped to a single ID. This means that no third party will be able to steal any identity since the system will detect the mishap immediately.

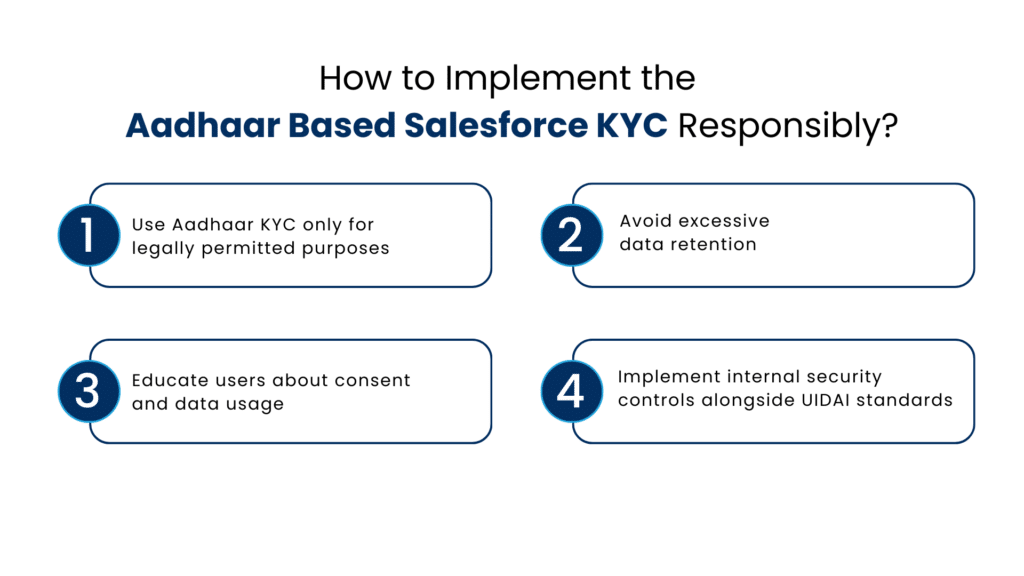

How to Implement the Aadhaar Based Salesforce KYC Responsibly?

While the salesforce KYC aadhaar solution is a transformation in the KYC verification, it is extremely important to be responsible when implementing the solution and maintain data security.

Use Aadhaar KYC only for legally permitted purposes

Organizations must ensure Aadhaar-based KYC is used strictly for purposes allowed under UIDAI and applicable regulatory guidelines. Using Aadhaar data beyond authorized use cases can lead to legal penalties and loss of trust. Purpose limitation helps maintain regulatory compliance and protects user privacy.

Avoid excessive data retention

Aadhaar KYC data should be stored only for the duration required to meet regulatory or operational needs. Retaining data longer than necessary increases the risk of breaches and non-compliance. Implementing clear data retention and deletion policies strengthens security and accountability.

Educate users about consent and data usage

Users should be clearly informed about how their Aadhaar data will be used, stored, and protected. Transparent communication builds trust and ensures informed consent. Educated users are more confident and willing to engage with digital KYC processes.

Implement internal security controls alongside UIDAI standards

While UIDAI provides a strong security framework, organizations must complement it with internal controls such as access management, encryption, and regular audits. Layered security reduces vulnerabilities and enhances overall data protection. This approach ensures end-to-end security across the KYC lifecycle.

Conclusion

Aadhaar based KYC within salesforce is a far more convenient tool than paper-based KYC. It helps the companies in India ensure minimal data sharing, a robust identity verification system and data security.

For businesses operating in regulated environments, Aadhaar-based KYC not only reduces fraud and operational costs but also ensures alignment with India’s data protection and compliance standards.

When implemented responsibly, it enables organizations to build trust, protect user data, and stay compliant in an increasingly digital and regulated world.

FAQs

What is Aadhaar-based KYC and how does it work?

Aadhaar-based KYC is a digital identity verification process that authenticates individuals using their Aadhaar number issued by UIDAI. Verification is completed electronically through OTP or biometric authentication, making the process paperless, fast, and secure.

How does Aadhaar-based KYC ensure data security?

Aadhaar-based KYC ensures data security through encrypted data transmission, centralized UIDAI infrastructure, and consent-based authentication. Only limited and necessary information is shared, significantly reducing the risk of data breaches or misuse.

Why is paperless Aadhaar KYC more secure than manual KYC?

Manual KYC involves physical documents that can be lost, tampered with, or duplicated. Paperless Aadhaar KYC eliminates these risks by digitizing verification, maintaining centralized records, and reducing human intervention in the process.

What role does OTP and biometric authentication play in Aadhaar KYC?

OTP and biometric authentication add multiple layers of security by ensuring that only the legitimate Aadhaar holder can authorize the KYC process. This significantly reduces impersonation, identity theft, and unauthorized access.

How does Aadhaar-based KYC follow minimal data sharing principles?

Aadhaar-based KYC shares only essential identity attributes required for verification and does not provide access to the complete Aadhaar database. This consent-driven approach aligns with modern data protection and privacy standards.

For more insights, updates, and expert tips, follow us on LinkedIn.