How Salesforce DPDP Helps Ensure Safe & Compliant KYC Data Management?

In today’s modern era and digitally advanced business economy, organizations collect a vast amount of data to verify customer identities and remain compliant with the processes.

In this scenario KYC remains at the core of this data ecosystem, especially in industries like banking, finance, insurance, telecommunication, and healthcare. However, as the volume of data increases the risk associated with data privacy also increases.

In such a time when risk is so high, Salesforce and India’s Digital Personal Data Protection (DPDP) Act are enabling secure and compliant Know Your Customer (KYC) processes with the help of IdentryX. Since the businesses are now required to follow strict compliant procedures along with maintaining transparent communication procedures, the salesforce KYC solution makes this possible with its advanced OCR enabled technologies, AI based fraud detection, and multiple identity verification.

Understanding KYC Data and DPDP Act Requirements

Typically, the KYC data of a customer includes highly sensitive personal information like their name and address, Date of Birth (DoB), government issued identity numbers, contact details and demographic data, and supporting documents like Aadhaar, PAN, and GST certificates. Companies require this information to ensure that the customer has given correct and accurate data for verification purposes.

On the other hand, as per the DPDP act, this data is classified and must be protected against all odds.

It must be processed in accordance with strict principles including lawful and purpose limited data collection, explicit consent from data principals, strong data security guards, transparency, and the rights for individuals to erase, correct, or access data anytime they want.

Failure to comply with any of the above said instructions results in reputational damage, regulatory penalties, and most importantly loss of customer trust. And this is the point where the salesforce DPDP compliance capabilities through IdentryX become a strategic advantage for businesses.

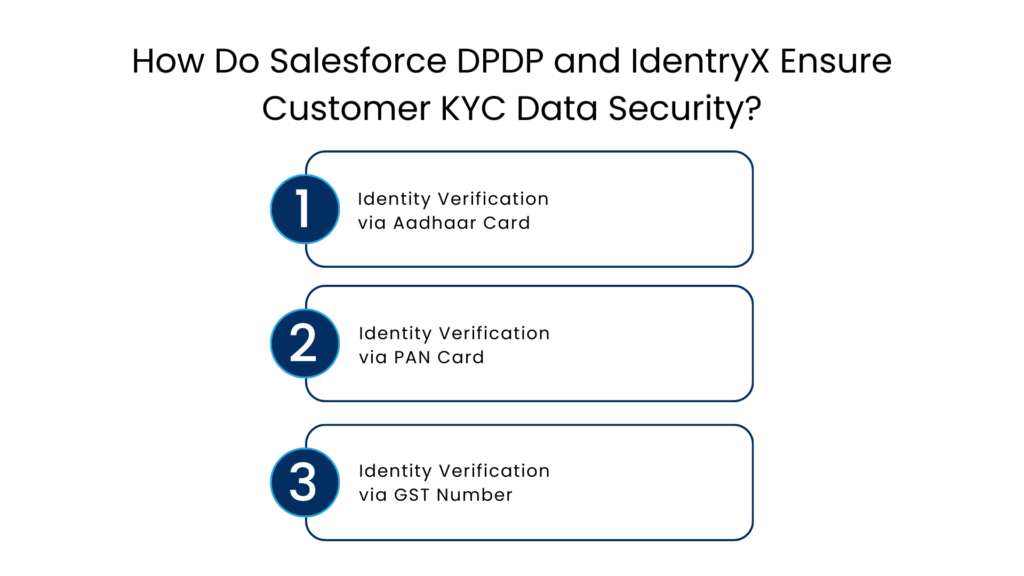

How Do Salesforce DPDP and IdentryX Ensure Customer KYC Data Security?

IdentryX, a KYC verification solution helps the businesses verify multiple identities at once including Aadhaar, PAN, and GST, while complying with the security norms and the conditions of the Digital Personal Data Protection Act. This salesforce based KYC solution makes the entire verification process and eliminates all manual checks.

Identity Verification via Aadhaar Card

When companies verify identities via Aadhaar card they securely fetch details via a One Time Password (OTP). Once the details are fetched, they are matched with the existing database and upon confirmation, a verification number is generated confirming that the details provided are correct and accurate.

Identity Verification via PAN Card

The PAN verification process is somewhat similar to Aadhaar. The major difference lies in the fact that in case of PAN, the verification is not done via OTP but through legal name and Date of Birth (DoB) provided in the legal document. The information is verified through trusted sources confirming the authenticity.

Identity Verification via GST Number

The GST verification is mostly done in case of large enterprises, but may be applicable to individual sources as well. Here, the verification is processed by entering the GSTIN. The salesforce ecosystem will detect and verify the GSTIN. These details are then confirmed with the concerned party and upon completion, the next steps follow.

Now when these processes are completed online within IdentryX, the complete KYC verification solution within salesforce it ensures 100% safety and security as per the law and the digital protection act. This is majorly due to the reason that data that is being verified stays inside the salesforce CRM and is only accessible to the selected parties.

What Makes IdentryX Compatible with India’s Digital Personal Data Protection (DPDP) Act?

Many organizations who are willing to opt for this solution may question its authenticity. The most common and most relevant question here is -’how is IdentryX complying with salesforce DPDP and ensuring data security?’

While the question is thoughtful and may seem complex, the answer is quite simple. This salesforce embedded KYC software is fully compliant with the legal norms. As soon as a customer is onboarded and they enter details for the KYC process, the system records the customer details. This means that once a customer has been added to the system, no new customer will be able to add their details with the same name and ID proof.

For example, let us say that person X has added their Aadhaar details including number, name, and address. The details are now automatically saved in the system. Now, assume that a person Y tries to enter the same details as X. The system will instantly detect this activity and report it as suspicious.

A salesforce KYC software is empowered with the latest AI abilities that allow the system to not only detect frauds, but it makes sure that only one person is mapped against a single ID. Since one person can add upto 3 IDs – Aadhaar, PAN, and GST, the system will make sure that one person is mapped against only 3 IDs at most, and no more.

Further, with the new development of digital signatures the customers can sign the documents digitally and ensure data security within salesforce via Aadhaar based authentication. Get documents signed effortlessly through OTP, bio-metric, retina scan or facial recognition. Fully verified and audit ready signatures help in ensuring trust and legal validity of the signatures.

How Does a Salesforce Enabled KYC Ensure Long Term Data Security & Compliance?

Implementing a salesforce DPDP KYC solution ensures compliance and long term data security by enabling streamlined KYC workflows and OCR enabled technology that verifies and extracts data automatically from the documents.

In addition to this compliant environment, it has added advantages for the business which are listed below. This DPDP KYC solution helps businesses scale faster and ensure enhanced data quality.

Lower Compliance Risk

By implementing structured data protection controls aligned with DPDP requirements, organizations can significantly reduce regulatory exposure. Consistent compliance practices help prevent violations, avoid penalties, and safeguard brand reputation.

Better Data Quality

Centralized data management and validation mechanisms ensure KYC data is accurate, consistent, and up to date across systems. Improved data quality strengthens governance and reduces errors that can impact compliance and operations.

Faster KYC Processes

Streamlined and automated KYC workflows minimize manual intervention and duplication of effort. This accelerates customer onboarding while ensuring verification processes remain compliant and auditable.

Smarter Business Decisions

Reliable and well-governed customer data enables better insights and informed decision-making. Teams can assess risk more effectively, personalize services, and respond confidently to regulatory and business needs.

Future-Ready Compliance

A scalable compliance framework allows organizations to adapt to evolving regulations and growing data volumes. This ensures long-term compliance readiness without disrupting existing operations or customer experiences.

Conclusion

KYC has become an integral part for businesses and along with ensuring legal norms, data security is at the core for these businesses. It has become mandatory for businesses to run accurate KYC processes and also comply with India’s Digital Personal Data Protection (DPDP) Act. In such a time, salesforce DPDP and IdentryX KYC verification solutions have become the new norms.

The software enables smooth onboarding process, safe KYC verification process either through Aadhaar, PAN, or GST, and data security through limited sharing across the organization. The AI abilities detect and prevent frauds at early stages, making it easier for the businesses to work at a faster pace without data breach.

FAQs

What is Salesforce DPDP compliance?

Salesforce DPDP compliance refers to configuring and using Salesforce in alignment with India’s Digital Personal Data Protection (DPDP) Act. It ensures personal and KYC data is collected lawfully, stored securely, accessed only by authorized users, and processed with full transparency and accountability.

Why is DPDP compliance important for KYC processes?

KYC processes involve sensitive personal data such as Aadhaar, PAN, and GST details. Under the DPDP Act, mishandling this data can lead to heavy penalties, reputational damage, and loss of customer trust. DPDP compliance ensures KYC data is protected, auditable, and legally processed.

How does Salesforce help in secure KYC data management?

Salesforce provides a secure CRM environment with role-based access control, encryption, audit trails, and centralized data storage. When combined with a KYC solution like IdentryX, Salesforce enables safe data capture, verification, monitoring, and long-term governance of KYC information.

What is IdentryX and how does it support Salesforce DPDP compliance?

IdentryX is a Salesforce-based KYC identity verification solution that helps businesses verify identities such as Aadhaar, PAN, and GST while complying with DPDP requirements. It eliminates manual verification, reduces fraud risk, and ensures data remains within the secure Salesforce ecosystem.

How does Aadhaar verification work in Salesforce KYC?

Aadhaar verification is performed through OTP-based authentication. Once the OTP is validated, the fetched details are matched with existing records. Upon successful verification, a confirmation number is generated, ensuring accuracy and compliance with data protection laws.

For more insights, updates, and expert tips, follow us on LinkedIn.