How Businesses Reduce Compliance Costs with GST based KYC automation CRM?

In today’s highly regulated business environment, GST compliance is no longer an option but a critical operational requirement. Businesses across industries are required to comply with the Know Your Customer (KYC) procedures and norms to avoid penalties, reputational damage and operational disruptions.

However, with a large pool of customer data flowing every day, manual KYC becomes tiresome and this is where a GST based KYC automation CRM like IdentryX becomes a necessity.

By leveraging GST data and automating the verification workflows businesses in India not only reduce the compliance costs but also increase the speed at which the KYC is completed. The data is secure and the automated workflows also help in ensuring accuracy, smooth operational workflows, and faster KYC verification and processing.

Moreover, when GST verification happens within an automated CRM like IdentryX, it maps the customer to that ID proof which reduces the risk of identity theft and fraud. This means that any identity thefts are detected instantly via AI and action can be taken immediately.

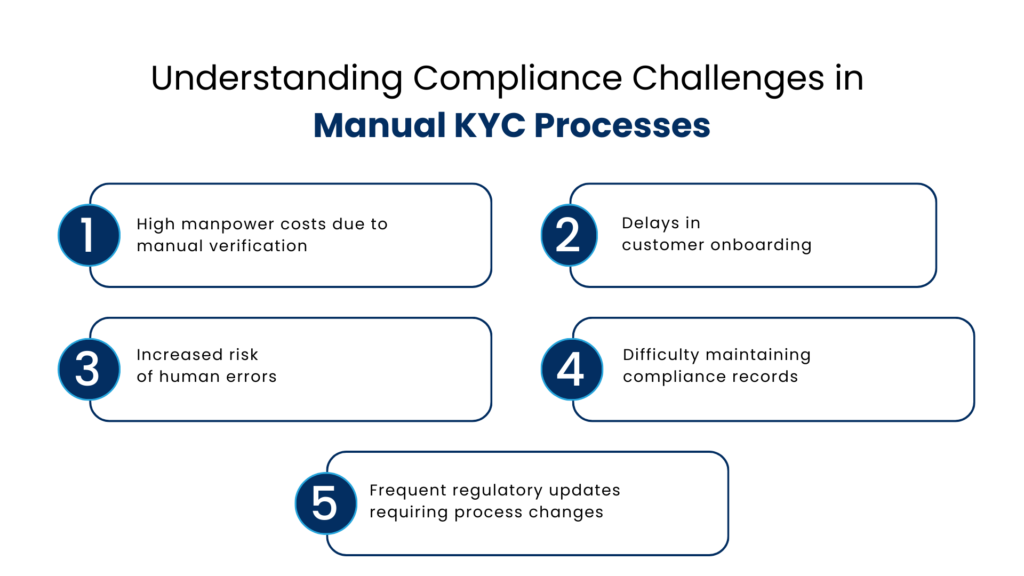

Understanding Compliance Challenges in Manual KYC Processes

Manual KYC processes involve collecting documents, validating GST numbers for all the customers individually, and maintaining audit trails. When this data is maintained manually via spreadsheets the risk of data loss and identity thefts is higher and the chances of duplicacy also increases.

High manpower costs due to manual verification

Manual verification requires dedicated teams to collect, review, and cross-check customer documents. As volumes increase, businesses must hire more staff, significantly increasing operational and compliance costs.

Delays in customer onboarding

Manual KYC processes involve multiple steps and approvals, often leading to long onboarding timelines. These delays frustrate customers, slow revenue generation, and create backlogs for sales and compliance teams.

Increased risk of human errors

Relying on manual data entry and document checks increases the chances of mistakes such as incorrect GST validation or missing information. These errors can result in compliance failures, penalties, or rework.

Difficulty maintaining compliance records

When records are stored across spreadsheets, emails, and disconnected systems, it becomes difficult to track and retrieve compliance data. This makes audits time-consuming and increases the risk of non-compliance.

Frequent regulatory updates requiring process changes

Regulatory requirements change regularly, and updating manual workflows requires retraining teams and modifying processes. This leads to additional costs, operational disruption, and slower compliance adaptation.

What is GST Based KYC Automation CRM?

In simple terms a GST based KYC automation CRM is the customer relationship management software that integrates GST verification into the salesforce CRM. It validates the customer details automatically against the government databases and stores the verified information within CRM.

With this automation the comGSTies can digitally verify the GST number, legal entity, address and business information, and accurately maintain compliance records. This automation ensures faster onboarding, reduced errors, and continuous compliance monitoring.

How Businesses Reduce Compliance Costs with the GST Verification Salesforce App?

When companies automate GST KYC in salesforce, they experience reduced compliance costs by almost 70% and enable faster business growth and scalability. The IdentryX solution is widely helping the companies in India to cut manual labour, centralise data and lower the audit costs, and update the salesforce identryX systems regularly for better performance rate.

Eliminates Manual Verification Efforts

Manual verification is one of the primary drivers of high compliance costs, as compliance teams spend significant time validating GST details, reviewing documents, and ensuring accuracy. A GST KYC automation CRM streamlines this process by instantly validating GST numbers, automatically fetching and verifying business information, and reducing the need for manual document checks. This automation lowers dependency on large compliance teams, improves accuracy, and significantly cuts labour costs.

Faster Onboarding and Reduced Operational Overheads

Delayed customer onboarding increases administrative workload and slows revenue generation, especially in B2B environments where manual KYC can take days or even weeks. Automated GST based KYC enables near-instant verification by validating details in real time and reducing dependency on manual checks. By eliminating repeated follow-ups for missing information and shortening onboarding cycles from days to minutes, businesses lower processing costs and accelerate revenue realisation.

Reduces Errors and Costly Compliance Failures

Human errors in manual KYC processes often result in compliance violations, financial penalties, and legal risks. A GST based KYC automation CRM applies consistent validation rules, minimises data entry errors, and maintains accurate compliance records across the system. By improving accuracy and standardising verification, businesses avoid costly rework, reduce audit risks, and protect their reputation.

Centralised Compliance Data Lowers Audit Costs

When compliance data is scattered across spreadsheets, emails, and disconnected systems, audit preparation becomes time-consuming and expensive. A GST based KYC automation centralises all KYC and GST records in one system, automatically maintains audit trails, and enables instant generation of compliance reports. This streamlined approach reduces audit preparation time, lowers associated costs, and minimises stress during regulatory reviews.

Automated Updates Reduce Regulatory Change Costs

Compliance regulations frequently evolve, making manual process updates costly and time-consuming. A GST based KYC automation CRM allows businesses to adapt workflows quickly through rule-based updates, reducing the need for extensive retraining or process redesign. This flexibility ensures faster compliance alignment and significantly lowers long-term compliance maintenance costs.

How is Salesforce GST KYC Integration Enhancing Risk Management and Compliance Governance?

With The Salesforce GST KYC integration the companies enable an improved risk management and compliance governance. With increasing regulatory scrutiny and complex compliance requirements, organisations must ensure accurate verification, consistent monitoring, and transparent record-keeping.

Proactive Risk Identification

A GST based KYC automated CRM software continuously validates customer data throughout the onboarding and verification process. It identifies invalid or inactive GST numbers, flags suspicious or mismatched information, and highlights high-risk entities at an early stage. This early detection helps businesses prevent compliance failures, reduce regulatory risks, and avoid costly penalties.

Stronger Governance and Accountability

A GST based KYC automation CRM strengthens governance by maintaining automated audit trails and enabling role-based access controls. All compliance activities become fully traceable, responsibilities are clearly defined, and internal governance standards are consistently enforced. This structured approach reduces long-term risk exposure and lowers the costs associated with compliance lapses.

Scalability Without Linear Cost Increases

As businesses scale, relying on manual compliance processes leads to rising costs and operational inefficiencies. A GST based KYC automation CRM enables organisations to manage higher customer volumes without increasing headcount, while maintaining consistent compliance standards. This scalable approach supports business expansion into new markets and ensures compliance costs do not grow proportionally with business size.

Conclusion

It is safe to say that GST verification is inevitable for KYC businesses in India and manual KYC processes have become obsolete. Therefore, a GST based KYC automation CRM is a necessity for businesses to fasten the customer onboarding process, reduce identity frauds and thefts and maintain data security.

In a compliance-driven economy, GST based KYC automation CRM is no longer a luxury but a strategic necessity for sustainable, cost-effective growth.

FAQs

What is a GST based KYC automation CRM?

A GST based KYC automation CRM is a customer relationship management system that integrates GST verification into the CRM workflow. It automatically validates GST numbers against government databases, fetches verified business details, and securely stores compliance records, enabling faster onboarding and accurate KYC management.

How does GST based KYC automation reduce compliance costs?

By automating GST verification and KYC workflows, businesses eliminate manual document checks, reduce dependency on large compliance teams, minimise errors, and lower audit preparation costs. This significantly reduces labour expenses and long-term compliance maintenance costs.

How does GST KYC automation improve customer onboarding speed?

GST based KYC automation enables near-instant verification of customer details, reducing onboarding time from days or weeks to just minutes. This eliminates repeated follow-ups, accelerates revenue realisation, and improves the overall customer experience.

Can GST based KYC automation help prevent fraud and identity theft?

Yes. Automated GST verification maps customer identities to verified government records and uses AI-driven validation to detect mismatches, inactive GST numbers, or suspicious entities early. This helps businesses identify fraud risks and take immediate action.

How does Salesforce GST KYC integration enhance risk management?

Salesforce GST KYC integration enables continuous data validation, proactive risk identification, automated audit trails, and role-based access control. This strengthens governance, ensures accountability, and reduces regulatory and operational risks.

For more insights, updates, and expert tips, follow us on LinkedIn.