Automate Customer KYC in Just 10 Minutes – Join The Salesforce KYC Automation Webinar

The Indian business landscape is changing and Know Your Customer (KYC) has become a crucial part of the businesses to protect consumer identity. IdentryX is solving this issue by bringing automated KYC in your phones. No going anywhere, no manual forms. To address this real-world solution, IdentryX is hosting an exclusive one time webinar.

This salesforce based KYC solution webinar will address the challenges faced in the manual KYC procedure and how IdentryX is solving this problem with just 10 minute KYC without compromising on compliance, security, and accuracy.

The webinar is designed exclusively for organizations who want to modernize onboarding, reduce operational costs, eliminate identity thefts and frauds, and enable Aadhar, PAN, and GST based verification effortlessly with E-signatures.

What Is IdentryX? – A Brief Overview of the Salesforce KYC Automation Webinar

Businesses in India are still stuck with paper based KYC processes which hampers and delays the onboarding process and increases onboarding costs as well. The customer data is mismanaged, and ID thefts become a raging issue. With this webinar, the potential customers get a detailed outline about the product and can enrol for the solution instantly.

To solve this issue and reduce these thefts, IdentryX is a dedicated solution developed by Manras Technologies. This salesforce based KYC automation in India has helped some major industry names like Acko, Adani Realty, Religare, etc. Streamline their KYC operations and handle everything paperless.

The solution is fully compatible with PAN, GST, and Aadhar based verifications and those who have onboarded with us, significantly reduced the KYC operational costs by 70%. They have experienced no identity thefts with this solution and have not faced any disruptions in their system as well.

Who Will Address and Lead the IdentryX Webinar?

The IdentryX webinar will be held and led by the expert who is driving the salesforce powered KYC automation – Aartie Saxena. She brings over 14 years of experience in solution consulting, specializing in designing and delivering scalable Salesforce solutions.

At Manras Technologies, she leads the consulting team, partnering closely with clients to understand their compliance, onboarding, and operational needs, and implementing Salesforce-based KYC and identity verification solutions that drive efficiency and growth.

With a strong understanding of industry-specific regulatory and business challenges, Aartie helps organizations streamline customer onboarding, ensure compliance, and optimize end-to-end operations. Her proven ability to manage complex implementations ensures every KYC integration aligns with business goals and delivers measurable value.

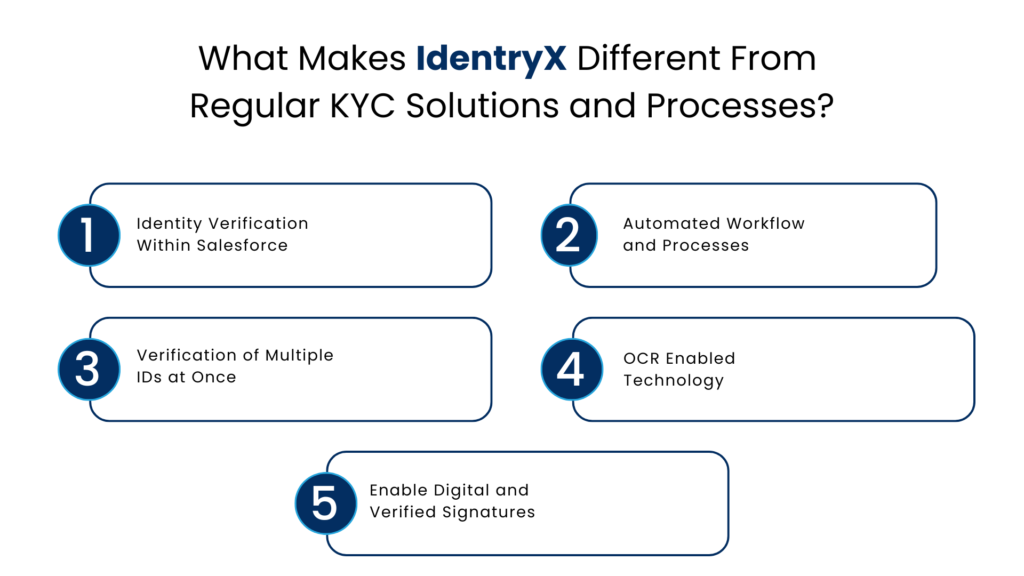

What Makes IdentryX Different from Regular KYC Solutions and Processes?

Most KYC solutions in India are manually led and involve scattered paper documents. This leads to either lost files or mismanaged data. But IdentryX is changing the way KYC processes work. This salesforce led KYC solution has automated the entire KYC process.

Identity Verification Within Salesforce

With AI enabled ID verification businesses need not rely on any kind of third party operations. They can easily verify Aadhar, PAN, and GST from within their salesforce systems. Businesses can fetch the identity details with OTP based Aadhar verification, validate PAN by matching legal name and DOB,and can also instantly verify GST number by checking the registered business details.

Automated Workflow and Processes

With the AI based KYC solution like IdentryX, the companies do not require any manual intervention. The entire KYC lifecycle is handled via automation and instant notifications and reminders are sent to the customers to complete their verification timely. On the other hand, once the client completes the verification process the company also receives a notification. This reduces the to and fro of long calls and emails, making the entire KYC process smoother.

Verification of Multiple IDs at Once

With smarter ID verification, businesses do not have to struggle with verifying one ID proof at a time. With the advanced technology the companies can verify multiple identities at once and all of them will be saved in the salesforce CRM for future processes. This also eliminates the problem of verifying a single customer multiple times for different requirements. With all data available at a single place, the companies can easily match the records and onboard faster.

OCR Enabled Technology

With the OCR technology enabled the businesses can automatically extract and verify data from documents. This allows for a faster and instant KYC verification and brings higher conversion rates. The customers can easily verify documents without any hassle and the data is secure as well.

Enable Digital and Verified Signatures

Businesses can now get the documents signed easily through digital signatures in Salesforce CRM via the Aadhar card. The signatures can be digitalised effortlessly with OTP, retina scan, facial scan or bio-metric. This enables paperless signatures reducing the risk of fraud and thefts by almost 90%.

What are the Business Benefits Highlighted in the IdentryX Webinar?

The IdentryX webinar by Manras is being held on 22nd January 2026, 11.30 a.m. onwards, for organizations who are looking to automate their KYC processes and want to achieve the 10 minute KYC rate. This webinar does not just focus on technology, but highlights the impact of automated KYC.

Faster Customer Onboarding

Automated KYC removes manual verification delays and completes checks in minutes instead of days. This allows customers to access services almost instantly, improving activation rates and reducing drop-offs.

Reduced Operational Costs

By automating document verification and compliance checks, businesses significantly cut down manual effort. This reduces the need for large compliance teams and lowers overall operational expenses.

Improved Customer Experience

A quick, digital, and hassle-free KYC process creates a positive first impression. Customers experience fewer steps, faster approvals, and greater convenience, leading to higher satisfaction and retention.

Stronger Compliance

Automation ensures every verification step follows predefined regulatory rules consistently. This minimizes human error, reduces compliance risks, and creates audit-ready records automatically.

Scalability Without Complexity

Automated KYC systems handle high onboarding volumes without adding operational burden. Businesses can scale customer acquisition smoothly while maintaining the same level of compliance and accuracy.

Conclusion – Future of Automated KYC

IdentryX is a one of a kind and the most powerful KYC solution for KYC processes in India. The salesforce based KYC solution webinar is a step to help organizations understand the value of true automation and aid them with the benefits of the KYC automation.

The salesforce KYC automation webinar can be attended online by registering free of cost, from the comfort of your home. Book your spot in the webinar before the seats are full!

FAQs

What is the IdentryX KYC Automation Webinar about?

The IdentryX webinar focuses on how businesses can automate customer KYC within just 10 minutes using a Salesforce-based solution. It explains how organizations can replace manual, paper-based KYC with a secure, compliant, and fully digital onboarding process.

Who should attend the IdentryX webinar?

The webinar is designed for organizations looking to modernize customer onboarding, reduce operational costs, and eliminate identity fraud. It is ideal for compliance teams, operations leaders, IT heads, and decision-makers across industries handling high-volume KYC processes.

How does IdentryX reduce KYC completion time to 10 minutes?

IdentryX automates the entire KYC lifecycle within Salesforce using AI-driven verification, OCR-enabled document processing, and automated workflows. This eliminates manual checks, paperwork, and follow-ups, enabling near-instant identity verification.

What types of identity verification does IdentryX support?

IdentryX supports Aadhaar, PAN, and GST-based verification. Businesses can verify identities using OTP-based Aadhaar authentication, PAN validation through name and date-of-birth matching, and instant GST verification using registered business details.

How does IdentryX ensure compliance and data security?

The solution follows predefined regulatory rules and automates compliance checks consistently. All verification data is securely stored within Salesforce, creating audit-ready records while minimizing human error and reducing compliance risks.

For more insights, updates, and expert tips, follow us on LinkedIn.