How Can a Vehicle Insurance CRM Make Your Delhi/NCR Team 4X More Efficient?

Vehicle insurance teams in Delhi/NCR are handling massive volumes of policies, claims, and renewals, and a vehicle insurance CRM in Delhi/NCR is instrumental in doing these tasks efficiently.

Essentially, agents are spending a lot of time manually tracking enquiries, updating records, and following up with customers. These repetitive tasks slow their productivity and bottlenecks are formed in the daily operations.

Today success is measured by speed, accuracy, and organization, among other things. Customers want instant responses and smooth service and agents require suitable tools to handle their workload effectively.

In this respect, a Vehicle Insurance CRM system is perfect for the job as it streamlines the daily tasks, automates the follow-up process, and gives your team an opportunity to be busy with the high-value work. Your staff with the right system then can become 4X efficient and use less of their time to close more deals.

Delhi/NCR Vehicle Insurance Team Signs That They Need a CRM

It is hard for your team to properly manage leads, policies, and claims, and a vehicle insurance CRM in Delhi/NCR is the solution to these problems. Delayed responses particularly infuriate new customers and therefore a company loses potential clients. Also, agents find it difficult to carry on with product renewals and follow-ups when they are still using manual processes.

Continuously repeating tasks are exhausting your staff and thereby they have fewer hours left in which to do valuable activities like closing deals. Not having a clear look at customer interactions as well as the sales pipeline, your team is not in a position to make the right decisions and prioritize leads effectively. If these are the words that you recognize, then a CRM will revolutionize the way you work and increase your overall productivity.

Key Benefits of Vehicle Insurance CRM

Every day, vehicle insurance staff in Delhi/NCR are confronted with a multitude of policies, claims, and inquiries. A vehicle insurance CRM in Delhi/NCR is the solution to the problems faced by your team.

The latter is not only the automating of everyday tasks but also the centralization of data and allowing agents to engage in high-value activities. The implementation of a proper CRM tool will enable your team to respond to customers at the earliest, handle policies in an orderly manner and drive customer satisfaction towards the highest level.

First and foremost, the vehicle insurance CRM in Delhi/NCR is in charge of giving an immediate response to every potential customer. Inquiries are addressed by your team in a timely manner, thus, prospects are attracted to the pursuit and chances of skips are reduced considerably.

Better policy and claims management

Through the platform, all the policies and claims are open for the agents at one place. They quickly get the details of a policy, perform renewals in an efficient way, and facilitate the resolution of claims in a speedy manner.

Automated reminders for renewals

The CRM for insurance agents in Delhi/NCR system issues renewal notifications automatically, hence, your staff is always on target with their deadlines and customers get a sense of being truly supported while the process is ongoing.

Centralized data for better decision-making

Every bit of customer information along with interaction is gathered into one unified system. Agents have the liberty to decide and set priorities based on the actual state of the affairs as they come from the insights.

Better communication and increased responsibility

By keeping track of the activities and duties, the CRM is a kind of ‘manager’ for the team. Therefore, each member finds himself/her-self being in tune with others, working efficiently, and contributing to the rapid and smooth completion of tasks.

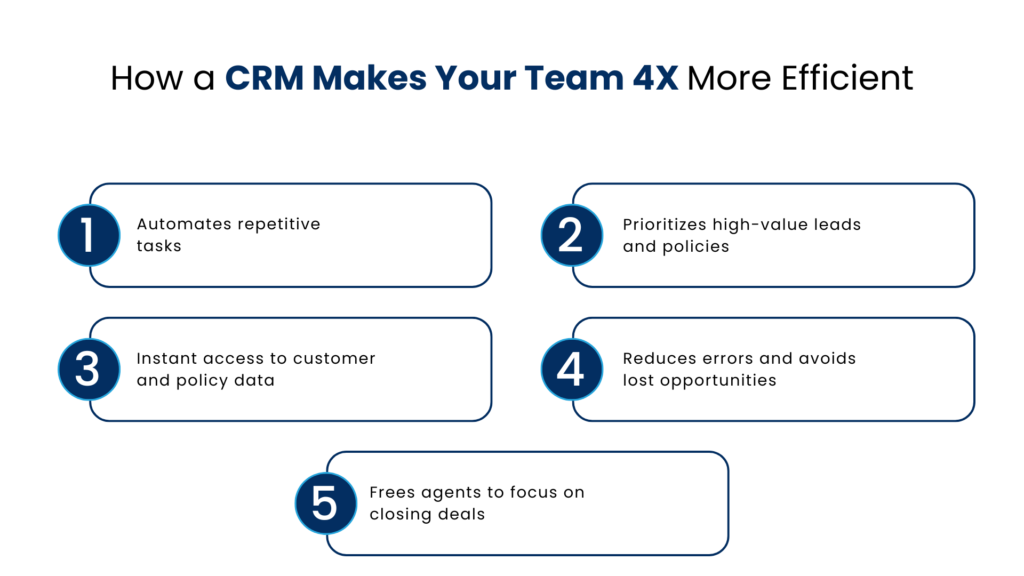

How a CRM Makes Your Team 4X More Efficient

Vehicle insurance teams handle hundreds of policies, claims, and enquiries every day, and a vehicle insurance CRM in Delhi/NCR helps your team multiply efficiency. In essence, it performs those tasks which are typically done manually, arranges data, and thus, pels can be aimed at high value tasks. By employing the correct CRM, your band will rise to the level of performance required to meet deadlines, make the fewest mistakes, and seal the most deals in the shortest time.

Automates repetitive tasks

Furthermore, the CRM takes care of follow-ups, documentation, and notices automatically. Agents no longer have to allocate time to the execution of the daily work and can thus, put their strength into the most valuable interventions with customers.

Prioritizes high-value leads and policies

The software peaks out those leads that have the highest potential as well as those policy comes that need the most urgent attention. Your staff will then work on the projects which will yield the most significant results.

Instant access to customer and policy data

In such instances, agents are to simply access the information they are on the lookout for and get on with their job. They turn into the competent ones and do the right thing at the right time and thus hunting for detail is removed.

Reduces errors and avoids lost opportunities

One major advantage that comes about through automation is the decrease of mistakes in documentation and follow ups. Therefore, not one single lead or opportunity will be left untouched by your team because they will have been thoroughly gotten hold of.

Frees agents to focus on closing deals

On account of the automation of routine tasks, the building up of your team will be done mostly through relationship management, complex queries, and policy closure. The result will be increased productivity and better output.

Enhancing Customer Experience with CRM

Customer expectations in vehicle insurance are higher than ever, and a vehicle insurance CRM in Delhi/NCR plays a significant role in enabling your team to meet them efficiently. It enabled quicker communication. It delivered accurate information every time.

Further, it also ensured that customers felt supported from beginning to end. The thing with the correct CRM is that it can provide your team with the opportunity of giving trustful personalized customer experience which in turn leads to customer loyalty.

An instant reply to the customer’s questions is a feature that the CRM offers to the agents. Customers receive accurate information without delays. This builds their trust in your services and strengthens your relationship with them.

Agents efficiently handle claims and policy updates via the CRM. Customers enjoy smooth experiences without unnecessary back-and-forth. This reduces their frustration and keeps them engaged.

The system keeps tabs on customer preferences and history. Agents deliver tailored messages and suggestions, thus the buyers remain engaged during their journey.

Customer satisfaction improves with quick responses, accurate updates, and personalized service through a vehicle insurance CRM in Delhi/NCR. Satisfied customers stay loyal because they trust the support they receive. They continue to renew their policies regularly. Their loyalty strengthens your business and creates long-term growth.

Real-World Impact: Metrics to Track

Vehicle insurance teams want to measure their results. A vehicle insurance CRM in Delhi/NCR helps your team track performance easily and efficiently. The CRM streamlines the entire workflow. It collects and stores data neatly. It also lets managers monitor key metrics that reflect real progress.

Agents are quicker in the lead response and claim processing in the presence of a CRM. Customers are updated in a timely fashion, and your team is able to wrap up the pending tasks in a few minutes rather than hours.

The system helps agents focus their efforts on lead conversion. They follow up consistently and efficiently. This step considerably increases conversion rates and, at the same time, it brings about the timely renewals of policies.

Fast responses, accurate information, and personalized interactions improve the customer experience. Each element makes customers feel valued and supported. Satisfied customers stay loyal to you and often recommend your services to others.

Automation removes repetitive and mundane tasks. Agents gain more time and energy. They focus on closing deals and providing excellent customer service. Co-workers become more productive and can achieve better results with less effort by forming a group.

Conclusion: Why CRM Is a Game-Changer

Vehicle insurance teams use a vehicle insurance CRM in Delhi/NCR to get more work done in less time and with better quality. Agents respond rapidly, manage policies efficiently, and focus on high-value tasks. Customers benefit from timely updates, personalized service, and hassle-free claim support. This approach strengthens customer loyalty.

Integrating a CRM into an insurance agent’s daily routine in Delhi/NCR can completely transform their workflow and output. The system handles routine tasks, organizes data neatly, and guides agents to the most promising customers.

Don’t hesitate. Start using a Vehicle Insurance CRM today. Your team can accomplish four times more work while delivering exceptional customer experiences.

FAQs

How does a Vehicle Insurance CRM in Delhi/NCR improve team efficiency?

The CRM handles all mundane tasks automatically. It manages follow-ups, documentation, and reminders without manual effort. Agents can focus on high-value activities. They spend time closing deals and providing excellent customer service. The overall productivity increases because the team waits less and acts more.

Can a CRM help my team manage policies and claims better?

Certainly. The CRM consolidates all information about policies and claims. Without it, data would scatter across many locations. It lets agents access accurate information instantly. They process claims faster and track renewals with ease.

How does a Vehicle Insurance CRM enhance customer experience?

The CRM allows agents to respond lightning-fast. It ensures they provide accurate information every time. It also makes executing claims smooth and hassle-free. The system personalizes communication for each customer. It keeps customers engaged and enthusiastic throughout their journey.

What metrics should I track to measure CRM impact?

You should look at response times, lead conversions, policy renewals, and customer satisfaction scores together with agent productivity. Keep an eye on these parameters. They reveal the influence a CRM has on efficiency. They also show the impact on overall business results.

How quickly can my Delhi/NCR team see results with a CRM?

Immediately, your team responds to leads faster. Customer engagement reaches a higher level. Efficiency improvements become visible quickly. Agents achieve higher conversions. They experience a reduced workload. These results appear once the team fully embraces the system and streamlines their workflows.

For more insights, updates, and expert tips, follow us on LinkedIn.